Introduction

It is no secret that finance departments have been a target for process automation and the elimination of physical content. Accounts payable and accounts receivable encompass many of the most critical of processes for any business; it may sound trite, but cash is indeed the lifeblood of the organization - a major source of competitive differentiation is how efficiently payment processes are carried out. Furthermore, improper AP/AR management can lead to unhealthy cash flows, unpredictable days sales outstanding (DSO) or exception reconciliation, and worst of all, a lack of transparency into financial processes.

“…cash is the lifeblood of the organization - a major source of competitive differentiation is how efficiently payment processes are carried out.”

What’s surprising about today’s business landscape in finance, however, is that AP and AR are often treated as part of the enterprise wallpaper - an unavoidable overhead that isn’t consistently given the strategic priority needed for targeted performance improvement. There’s much talk about putting a lid on costs and lowering the labor commitments needed to carry out payment tasks, but worryingly less to do about fundamental process improvement at the source. The overall quality of payment processes, from rate of payment cycles, efficiency, and the degree of accuracy is what gives shape to the customer experience, as well as maintains productive relationships with our suppliers. When payment processes become overloaded or are not well optimized the quality of our business relationships suffer. Equally, poor payment processes can disrupt cash flows. Slow collections, missed early payment discounts, and long to resolve transaction disputes cause organizations to forfeit cost savings they would have otherwise claimed.

“…finance traditionally has been reliant on duplicative, error-prone manual processing - intelligent process automation works to disrupt this model…”

Today, paper-based, manual, or unoptimized processes are the primary anchors which hold back progress for process improvement in finance. These underperforming processes put pressure on organizations to transition into automated accounts payable solutions. It is a strategic imperative for today’s finance departments to be well integrated with content management solutions such as enterprise resource planning (ERP) systems. The goal is to confidently manage non-invoice financial formats such as purchase orders, unstructured financial documents like contracts, or electronic data interchange (EDI) files to the same degree as run-of-the-mill invoices. The growing ubiquity of workflow automation solutions to automate core financial workflows is giving way to a growing trend to improve AP and AR processes. Where finance traditionally has been reliant on duplicative, error-prone manual processing, automation works to disrupt this model and reassign professionals to more value added jobs. When process improvement is achieved in finance, it leads to the following benefits:

- Faster AP process cycles

- Reduction in exposure to compliance issues

- Improved financial reporting

- Increased visibility and collaboration within the AP process

In this report, we put the following question to the test: is process improvement in finance a worthy pursuit for our organizations? To prove this, we will examine how invoice automation is performing in accounts payable with a by-the-numbers cost breakdown gathered from current finance segment research. Then mining our findings, we will assess drivers, strategy, and benefits stemming from process improvement projects in finance, and conclude our research by discussing how to justify the cost of an AP/AR automation initiative. The following topics will guide discussion:

- How are organizations approaching invoice processing management, and what are their average costs?

- What are the top operational drivers for improvement and AP automation in finance?

- What comprises the typical financial ecosystem?

- Which automation capabilities are of highest value and priority for implementation?

- How are AP/AR systems being integrated?

- A look ahead to the future to understand emerging technology, return on investment, and justifying the cost of AP/AR automation projects.

Key Findings

Polling 142 respondents identifying in the finance and accounting field, we mined end user opinion to find out how businesses are approaching AP/AR process improvement and automation in finance.

- 14% are centralized but still paper-based. 14% majorly process invoices locally - on paper.

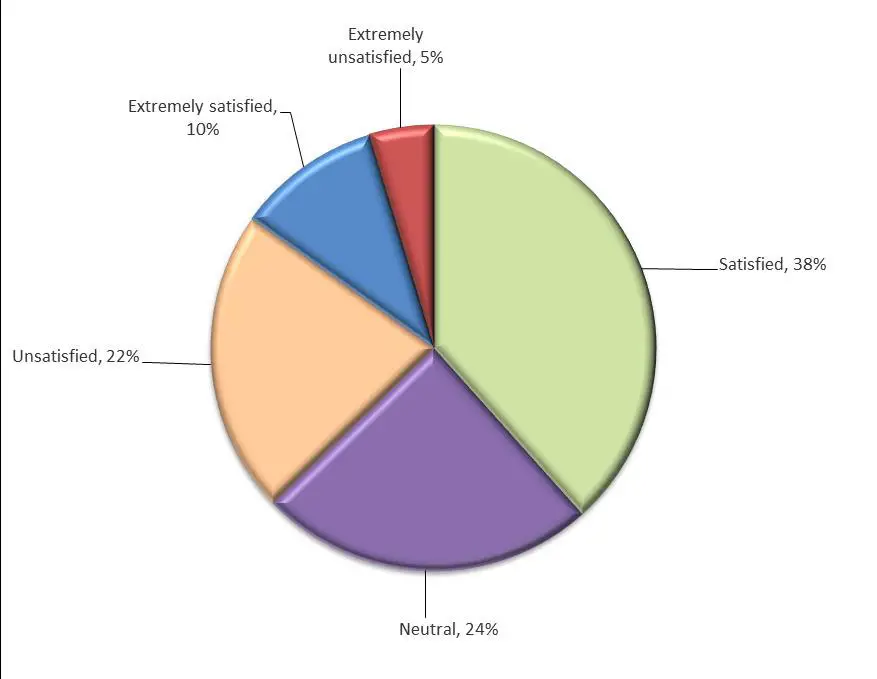

- 24% express indifference, and 22% express dissatisfaction.

- 22% confess only a quarter of their invoice processing operation is automated.

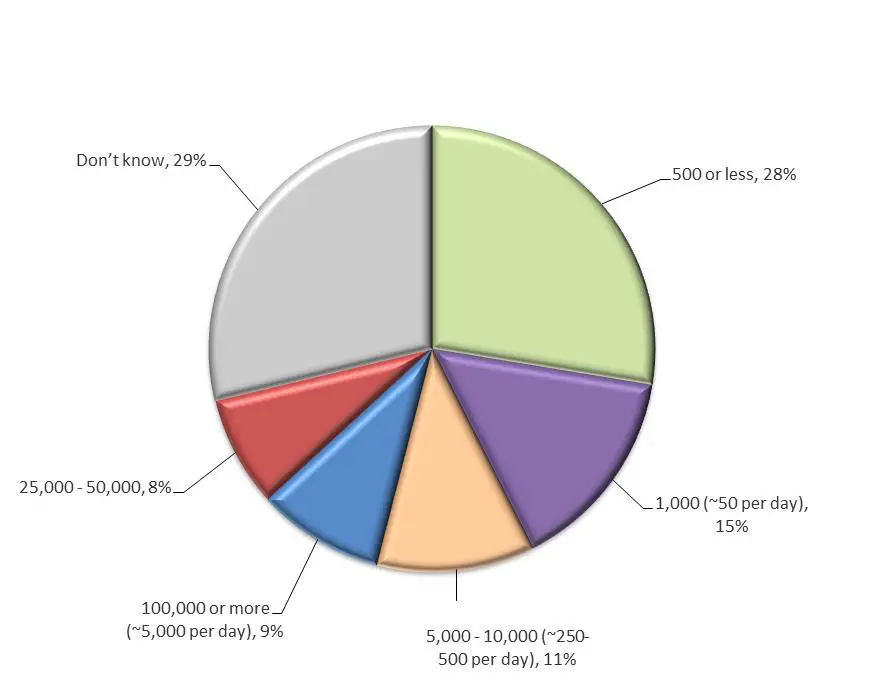

- 11% process between 5,000 – 10,000 invoices per month or approximately 250-500 per day.

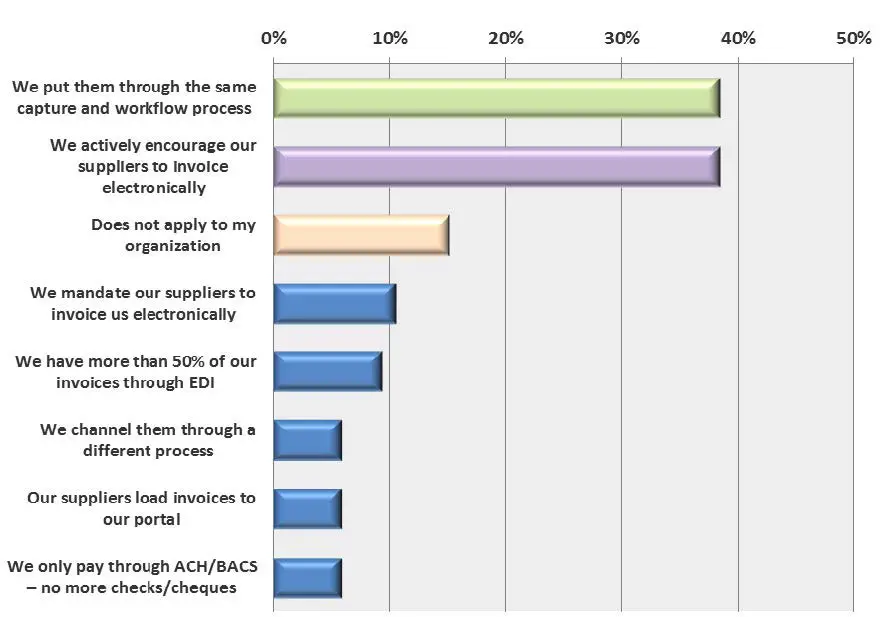

- In equal measure, 38% actively encourage their suppliers to invoice electronically.

- On the other hand, 24% report invoice processing cycles of less than a day via an invoice processing automation solution.

- Conversely, 24% report payment hold patterns/waiting periods of less than a day via an automated solution.

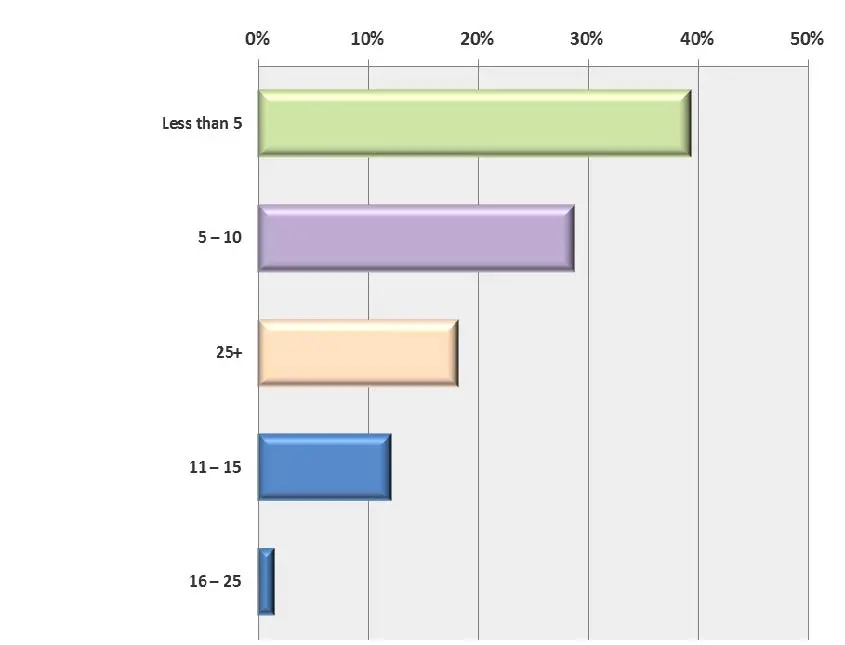

- 29% staff 5-10 FTEs on their team responsible for invoice processing activities, while 18% use 25+ FTEs.

- 12% calculate $8-$10 to process each invoice, and equally, 12% process invoices with predicted charges of $2 or less per invoice.

- 23% estimate 25-30 debtor days on average, and 20% report average 30-35 DSO/debtor days.

- 18% are hindered by exceptions and forfeited funds between .5%-1% of invoice income each year.

- 18% report that exceptions have somewhat dramatically decreased in the last 18 months.

- 26% believe adoption of an AP automation solution would have no perceived affect on their invoice processing costs.

- 40% are incentivized by decreasing invoice cycle time, and 31% are driven by increasing transparency with AP/AR automation, or improving visibility of invoice status.

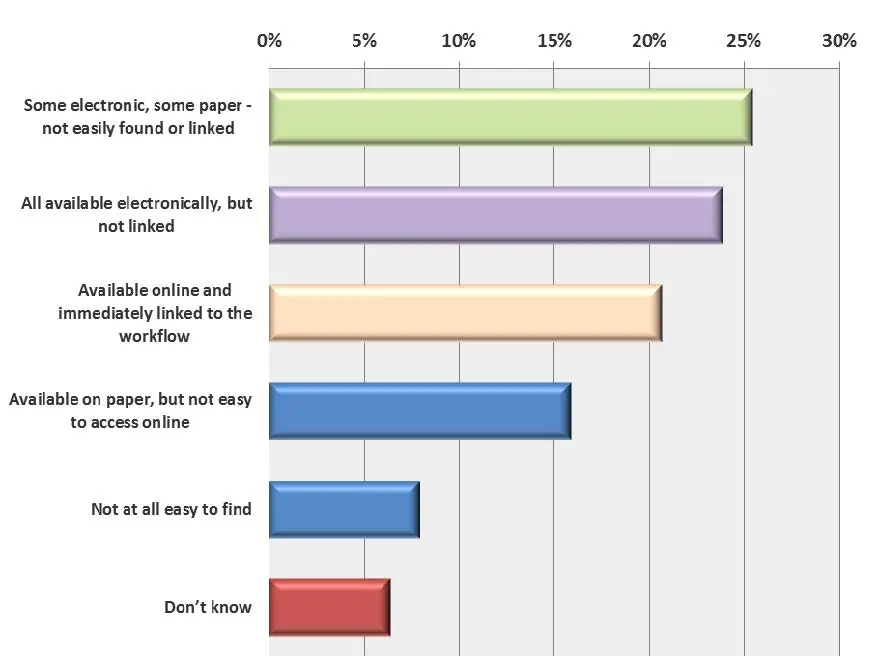

- 24% of organizations maintain digital access to finance documentation, but not linked to workflows; 21% report their important finance documentation is available online and immediately linked to the workflow.

- 22% developed an in-house solution, while 14% were supplied by their finance/ERP system supplier.

- 14% developed an in-house solution, while 13% purchased an AR automation solution.

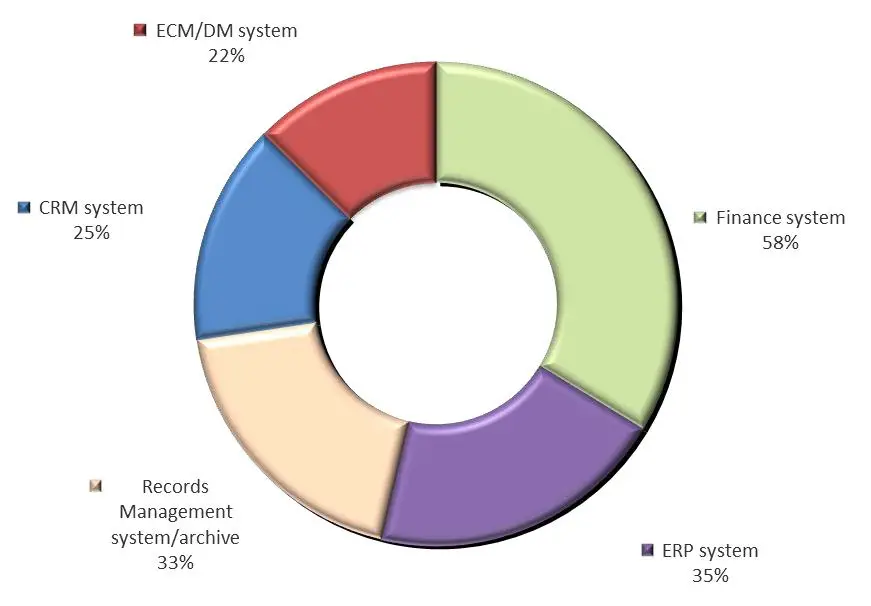

- 40% are integrating AP/AR with their ERP system, and 33% are driving integration to their records management system/archive.

- 13% are exploring options, while 11% are actively planning for it.

- 44% cite better records for audit trail or litigation as a major benefit, while 44%, in equal measure, report faster turnaround time to payment to be one of the biggest benefits to automating AP.

- 40% view better records for audit trails or litigation as a top automated accounts receivable benefit; 25% sharper cash-flow prediction.

- 36% achieve ROI within one year.

The State of Invoices

Invoice Processing Costs

Financial Transformation Drivers

AP/AR Automation Strategy

AP/AR Automation Benefits

AP/AR Automation Benefits

The State of Invoices

How automated is your invoice processing? In our recent industry watch research titled Automating Financial Processes (AP/AR) this was one of the initial questions we asked respondent organizations to answer in order to gain a baseline of the state of invoice processing. We gathered the following takeaways:

- 40% report that over half of their organization’s invoice processing is automated

- 22% confess only a quarter of their invoice processing operation is automated

Clearly, a number of organizations have applied invoice processing automation technologies within their finance department, but nearly a quarter struggle to automate a large share of their financial unit. It seems complete invoice processing automation is difficult to achieve - moreover, who can pin down what encapsulates the complete criteria and definition of what it means to achieve “100%” workflow automation. Since choosing a percentage value for AP automation is invariably subject to the “eye of the beholder,” we instead found end-user satisfaction to be a more telling metric. We asked respondents if they were satisfied with the current maturity of their organization’s invoice automation. Here are their answers:

- 48% of respondents are satisfied with their organization’s present invoice processing automation maturity

- 24% express indifference

- 22% are unsatisfied (Figure 1)

There is clearly no consensus or mandate of approval across all polled businesses. Granted, satisfaction tops out at nearly 50% for organizations polled - yet what can we infer for the other 50% who are less than satisfied with their organizations current finance intelligent process automation capabilities? Truly, a number of organizations seem not satiated in their appetite for financial transformation and better workflow automation, or perhaps not aware of the possibilities. This is significant as it shows a sufficiently hungry market for process improvement.

Today, the invoice processing remains the most commonly used vehicle for payments and is exchanged across most every business in both digital and paper formats. Gauging the amount of supplier invoices processed, we asked respondents to estimate the typical amount of invoices processed by their AP unit per month?

- 28% report their accounts payable unit processes 500 or less invoices per month

- 15% process 1,000 invoices per month or around 50 per day

- 11% process between 5,000 – 10,000 invoices per month or approximately 250-500 per day (Figure 2)

Non-standard Invoices and EDI

The reality is that electronic data interchange (EDI) has yet to take over enterprise finance, just as modern technologies like automation have yet to find a dominant foothold in the marketplace. However, in a previous AIIM report, Automating AP/AR Financial Processes – user feedback on the real ROI, AIIM analysts described the following trends:

“…there has been a considerable rise in the exchange of PDF invoices and EDI. Despite their universal file format, they represent a document of standard content but very diverse layout. As a result, although many organizations have adopted intelligent document processing of invoice images - scanned from paper or input as PDF - many are missing the true benefits of capturing the information on the document itself using OCR (Optical Character Recognition) and linking it direct to the finance or ERP transactional system2”

As anyone who works in finance will tell you, processing of payment requires more than just an invoice. AIIM analysts had this to say about the ballooning case file of documents required for payment processing:

“Delivery dockets, reject notes, inspection reports, remittance advice and original purchase orders will all be involved. If the transaction is a non-production purchase, non-goods order, high-value contract, or service agreement, an even greater bundle of contract-related documents may need to be referenced - contracts, correspondence, tender documents, inspection reports, corrective actions, and so on - in fact a full case file of documents2”

Fingertip access to this case file by all parties involved in the payment and approval process will be critical to productivity. If disputes escalate to a higher level, this ready access becomes even more important. In turn, every financial document needs to be captured, stored and linked to the transaction, then managed for access and collaboration, and finally archived at the end of the process.

Keeping in mind these alternate invoice formats and payment systems, we wanted to gain insight into how organizations generally deal with complex financial information and unstructured content beyond invoices. We asked respondents to let us know how they process invoices that arrive as PDF or through EDI:

- 38% rely on the same capture and workflow process for invoices arriving as non-regular or digital formats (e.g., PDF, EDI, etc.)

- An equal 38% actively encourage our suppliers to invoice electronically

- 15% say complex or non-regular invoice formats do not apply to their organization (Figure 3)

Invoice Processing Costs

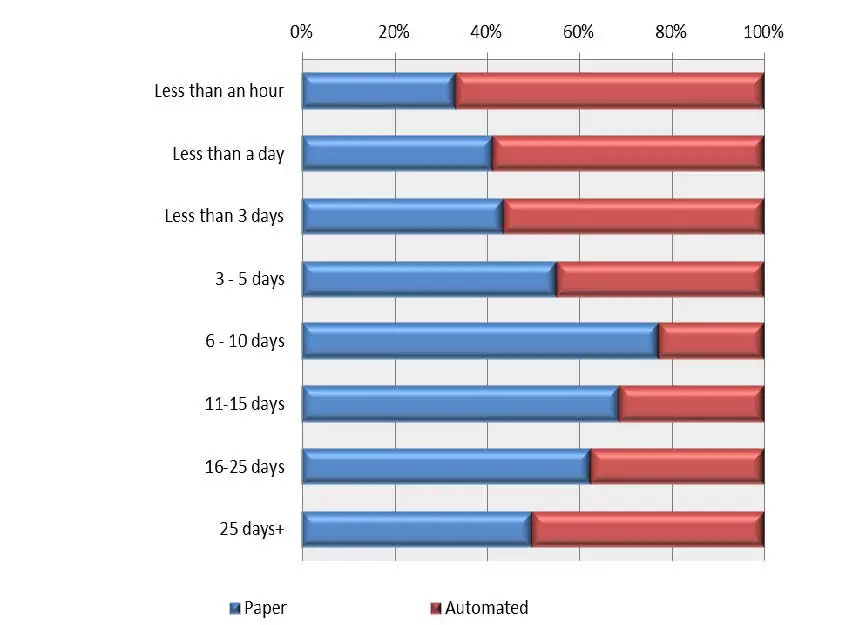

Invoice costs can vary considerably, especially between manual and automated accounts payable solutions. Comparing these costs is an ideal benchmark to view the potential of automation technologies in finance. For example, 21% say average time to process invoices via a paper-based solution is 3-5 days, while 24% report invoice processing cycles of less than a day via an AP automation solution. A remarkable 12% are experiencing average invoice processing times of less than an hour when enlisting an automated accounts payable solution. (Figure 4)

Hold patterns are also a major differentiator between paper and invoice processing automation solutions, and 22% say average time spent for payment hold patterns/waiting periods via a paper-based solution is 6-10 days, while 24% report payment hold patterns/waiting periods of less than a day via an accounts payable automation solution. Strikingly, there is a night and day difference in reported speed. (Figure 4)

Another major cost is the amount of workers and human resources dedicated to running payment operations and critical tasks. 61% of organizations report using at least 5 full time employees to run their finance department with invoice entry and matching tasks. On the high-end, 20% of companies say they use 16 or more fulltime employees to accomplish tasks related to invoice management. This high volume of workers dedicated to finance tasks is typical to paper-based AP systems, where manual tasks consume a lot of worker bandwidth preventing them from more value added positions.

On the other hand, 39% depend on less than 5 FTES (Full-time employees) for invoice entry and matching tasks. There are many possibilities with AP automation - when machine learning and AI substituted in place of these human workers taking over manual tasks. The net result when labor is reassigned to more value added roles includes cost savings, productivity gains, and heightened opportunities. (Figure 5)

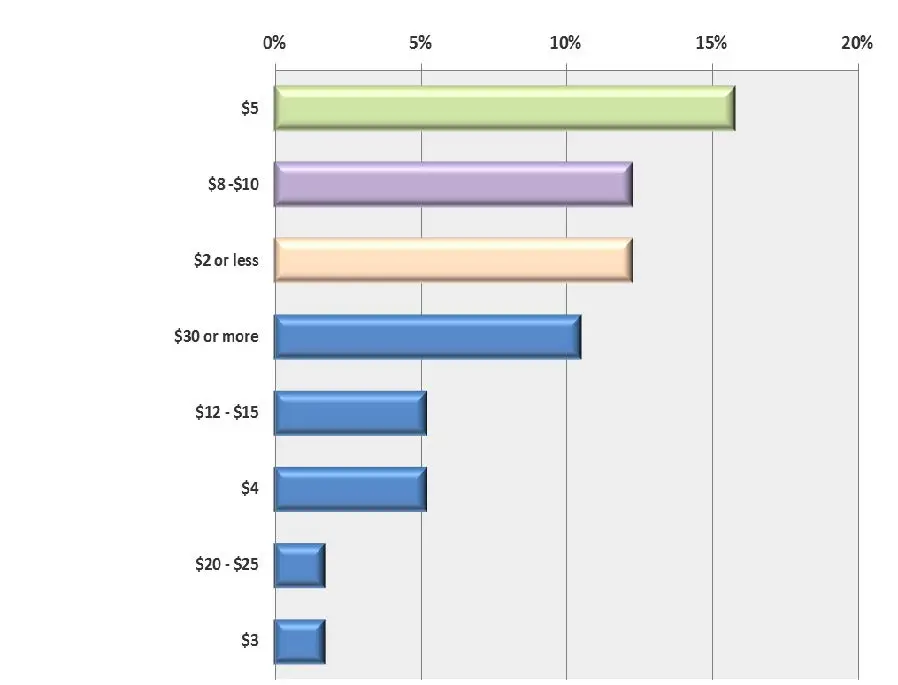

Moving on, we broke down the average invoice processing costs as estimated in USD. Approximately 5$ USD is where the highest number of organizations landed on at 16%, but results were, expectantly, mixed.

- 46% reveal invoice processing costs of $5 or more

- 16% estimate their invoice processing costs to be $5 per invoice

- 12% calculate $8-$10 to process each invoice

- 12% process invoices with predicted charges of $2 or less per invoice (Figure 6)

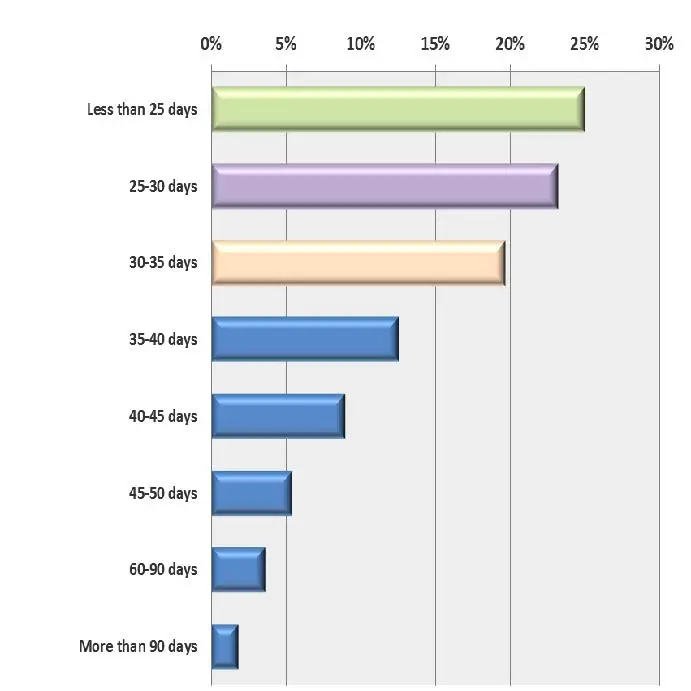

Exceptions are also of major importance to understand the total costs of invoice processing. We found the following average DSO (Days Sales Outstanding) as reported to be the following:

- 25% say their average days sales outstanding is less than 25 days

- 23% estimate 25-30 debtor days on average

- 20% report average 30-35 DSO/debtor days (Figure 7)

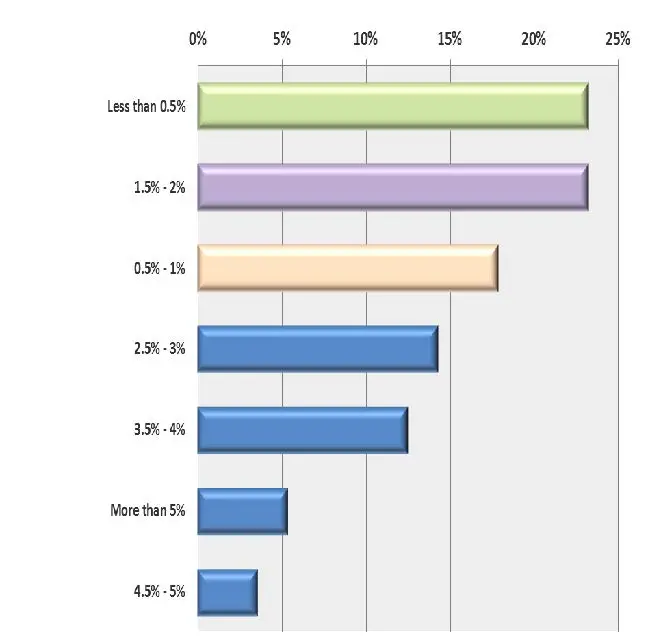

Invoiceable income lost due to exceptions is disclosed as follows:

- 23% report less than .5% of invoiceable income is loss per year due to exceptions

- 23% experience losses of 1.5%-2%

- 18% are hindered by exceptions and forfeited funds between .5%-1% of invoice income each year (Figure 7)

Labor demands, processing costs, and exceptions. Underperforming financial processes can rapidly lead to ballooning costs and out of control cash-flow in businesses. Process automation and improvement has been posited as a solution by vendors - perhaps a powerful tool finance departments need to stay out ahead of these costs. However, it is important to better understand the perception as it exists in organizations dealing with this question on the ground. As we know, there is no silver bullet solution for any business problem, but do most companies believe automation to be a tool to reduce invoice processing costs?

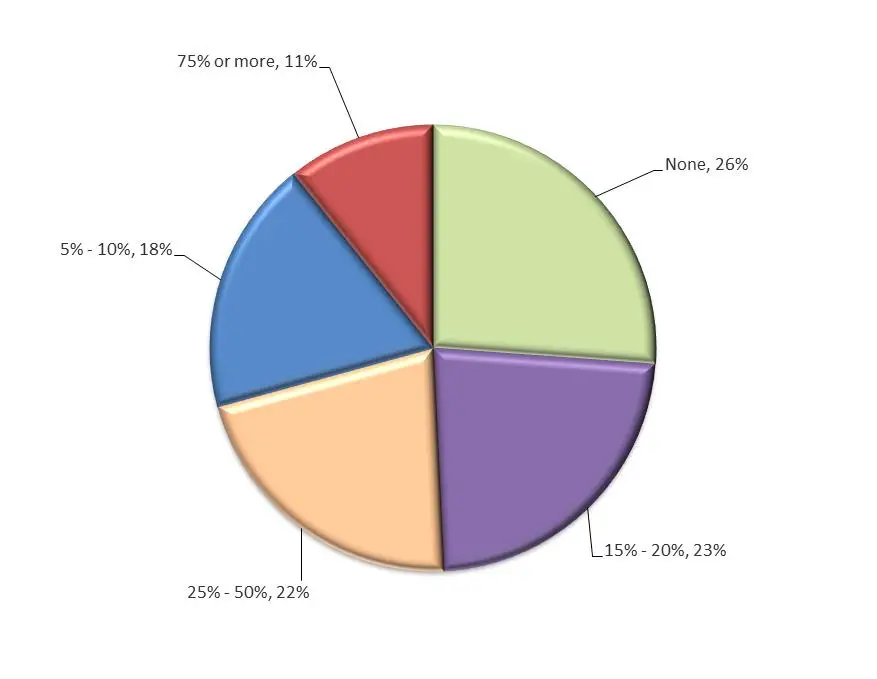

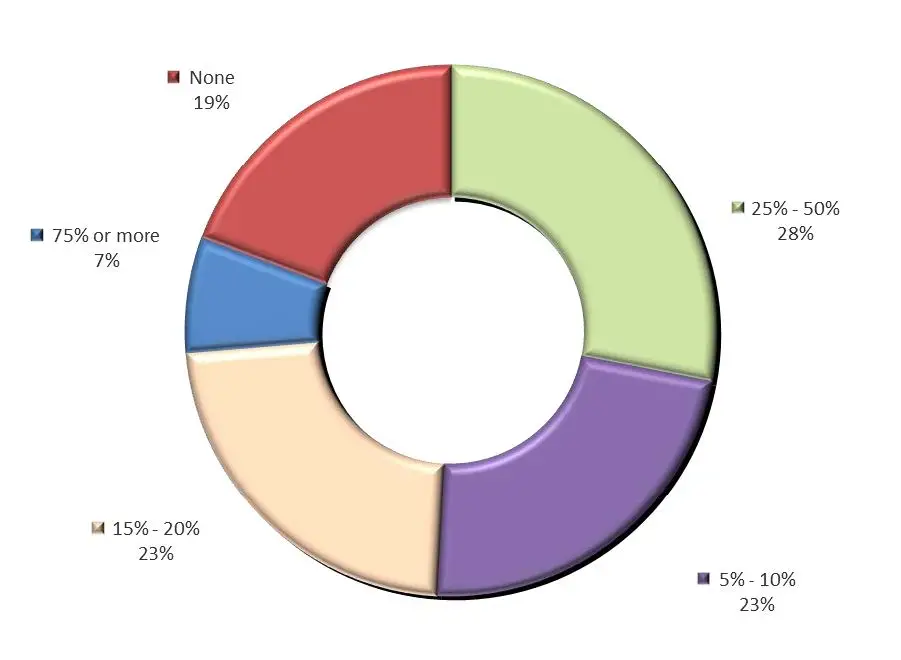

To find out we asked respondents by how much they thought adopting an automated accounts payable solution would help to reduce processing costs per invoice. While 26% believe that adoption of an AP automation solution would have no perceived effect on their invoice processing costs, 74% feel that an invoice automation solution would have at least some noticeable positive effect, and from this 74%, more optimistic predictions were seen:

- 23% predict a 15%-20% cost reduction by deploying an AP automation solution

- 22% feel invoice cost reductions of 25%-50% to be expected with AP automation (Figure 8)

AP/AR Automation Drivers

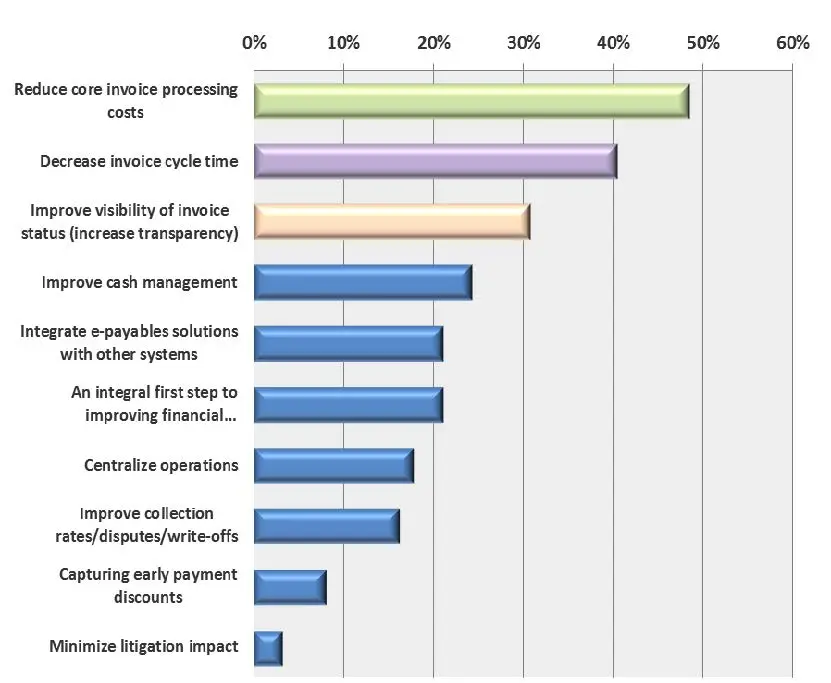

There are many reasons to Automate AP and AP processes, but here is a list of top drivers as gleaned from our survey:

- 48% highlight reducing core invoice processing costs to be a top driver for AP/AR automation

- 40% are incentivized by decreasing invoice cycle time

- 31% are driven by increasing transparency with AP/AR automation, or improving visibility of invoices

- 23% improve cash management

- 21% integrate e-payables solutions with other systems (Figure 9)

Many organizations are mired in escalating costs of manual invoice entry and matching tasks, as well as lack meaningful visibility into their payment systems. As we’ve seen, automated invoicing and financial processes are not default in today’s organizations, and many businesses remain throttled to the speed of paper and the opacity of manual processes.

AP/AR Automation Benefits

Leveraging intelligent process automation, end users have seen more timely reconciliation of outstanding payments, shorter DSO, and less time and energy spent chasing payments. AP/AR automation frees up the workforce to focus on high value work. Transparency provides unprecedented visibility into scheduled payments - if it’s been lost, ignored - and status of critical cash; all of these can be proactive to make informed decisions.

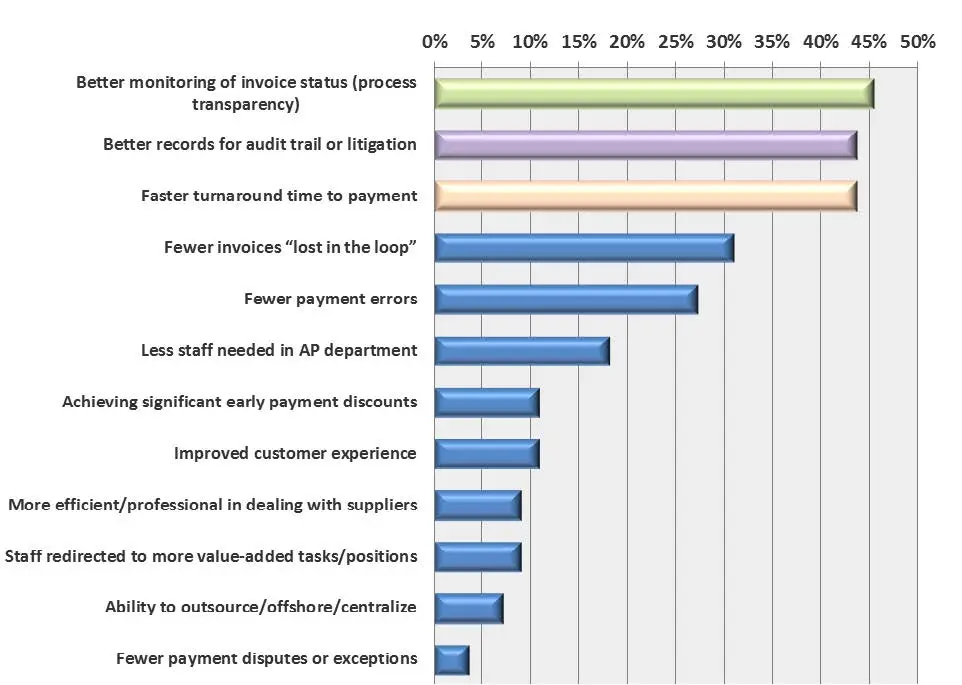

These claims are well evidenced in our poll: the following AP automation advantages are cited as the most valuable by respondents:

- 45% find better monitoring of invoice status (process transparency) as a top benefit of their AP automation solution

- 44% cite better records for audit trail or litigation as a major benefit

- 44%, in equal measure, report faster turnaround time to payment to be one of the biggest benefits to automating AP (Figure 10)

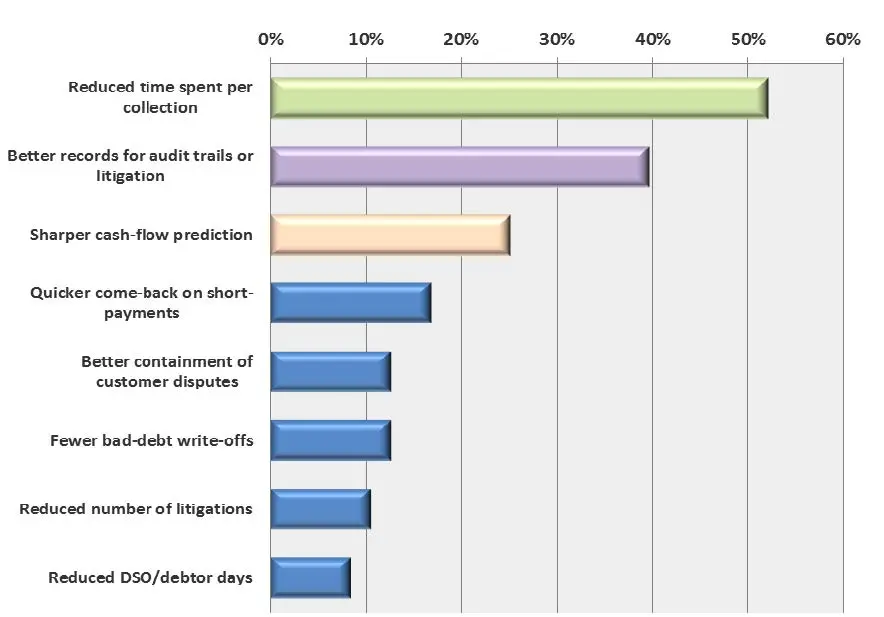

In the same vein, the following benefits are reported to be top-of-mind in respect to an AR automation solution:

- 52% highlight reduced time spent per collection as a major benefit of AR automation solutions

- 40% view better records for audit trails or litigation as a top automated AR benefit

- 25% say the most valuable benefit is sharper cash-flow prediction (Figure 10)

AP/AR Automation Workplace

Information fuels finance and must be surfaced quickly, accurately, and securely to the right processes or people at the right time. However, as we’ve seen, financial content comprises more than just invoices, but all of this content must be effectively circulated and exchanged to run financial processes effectively. However, how many businesses have established this kind of business environment? When we asked how accessible critical financial content is to an organization's AP unit, 25% describe a finance environment of some digital, some paper, where important finance documentation is not easily found or linked. Conversely, 24% of organizations maintain digital access to finance documentation, but not linked to workflows. (Figure 11)

An exemplary 21% of organizations polled report their important finance documentation is available online and immediately linked to the workflow for intelligent document processing, which is the ideal state, and should inspire future workplace improvement goals. This again is a place where workflow automation really shines in its ability to route more unstructured data, complex formats, and financial content like POs, and ensure that information is being delivered in a uniform way - with higher accuracy and consistency than what is possible with human workers. (Figure 11)

AP/AR Automation Integration

Consolidating financial systems under a central, enterprise-wide platform is the best way to ensure financial content is delivered securely, compliantly, and to schedule. Respondents reveal integrating their AP/AR solution to their software and system infrastructure in the following ways:

- 58% integrate their AP/AR solution - and vice versa - with their other finance systems

- 40% are integrating AP/AR with their ERP system

- 33% are driving integration to their document management system/archive (Figure 12)

AP/AR Emerging Technology

New disruptive technology always threatens to upend business as usual. This holds true in finance as digital transformation technologies in machine learning and robotic process automation are on the rise. As these technologies mature, new burgeoning applications relevant to financial processes have blossomed, and decision makers must decide whether to trail-blaze the path forward as an early adopter, patiently wait for proven ROI, or buck the technology as a short-lived trend - but of course, risking falling behind competitors if this technology beats the odds and takes root.

Inquiring into the impending robot revolution, we asked organizations if they were currently exploring options for robotic process automation solutions:

- 48% have no plans for robotics in finance at this time

- 13% are exploring options

- 35% reported improved quality of product or service is most useful

- 11% are actively planning for it (Figure 13)

AP/AR Automation – Deployment Options

There are various delivery models organizations can use to automate their AP and AR processes. The primary ways intelligent document processing is administered whether in finance, human resources, or another industry or department are the following:

- On-premise: intelligent process automation technology is purchased or built in-house and then hosted on-premise, operated by on own IT infrastructure

- Cloud Services: intelligent automation solutions are hosted off-premise in the cloud, with technology infrastructure hosted off site; the backend heavy lifting carried out via a cloud provider, while process operations handled back at base by the organization

- Outsourced: from platforms to processes, process automation solutions are entirely off-loaded to a third-party

Tracing the purchase plans of organizations participating in our survey, we asked respondents what kind of solutions to optimize your AP and AR processes would they be more likely to purchase in the next 12 months to 2 years:

- 17% plan AP/AR solutions installed on our own IT infrastructure

- 14% will invest in AP/AR cloud-based software automation (public or private SaaS)

- 10% are on course to implement AP/AR solutions delivered by a third-party provider as a managed service at our office

- 10% will purchase hybrid AP/AR solutions that could be partly delivered in the cloud, on-premises, or outsourced

- 3% seek to buy AP/AR solutions delivered by a third-party provider as an outsourced service out of our office

AP/AR Automation ROI

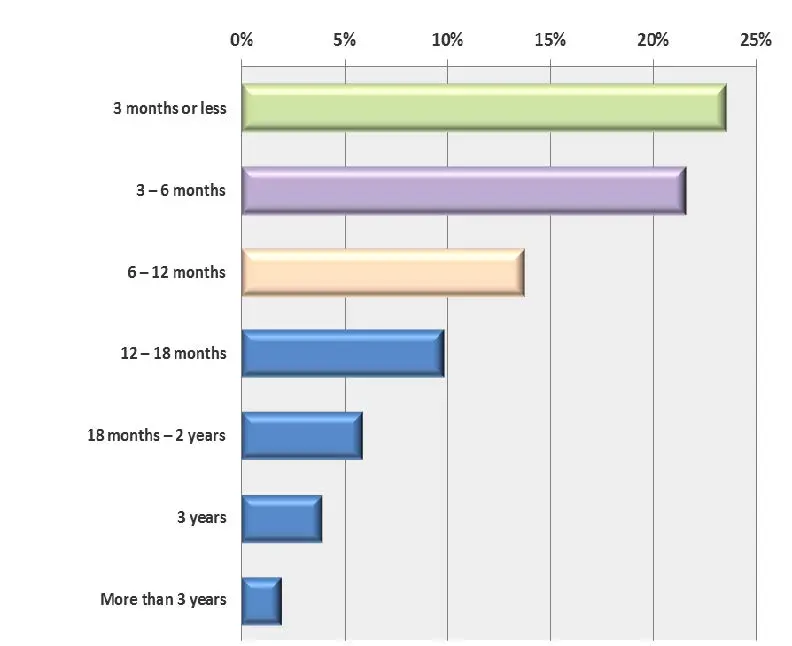

One of our most interesting areas of research was in measuring the return on investment AP/AR automation solutions typically achieve. When asking respondents how much an automated accounts payable solution has reduced processing costs per invoice, we learned that 28% report reductions in cost of 25%-50% by adopting an automated accounts payable solution (Figure 15).

Moreover, we found that fast return on investment was not only possible, but a common result among poll takers. 24% of organizations reported achieving payback from an automated AP/AR solution in 3 months or less, while 36% achieved ROI within one year. (Figure 16)

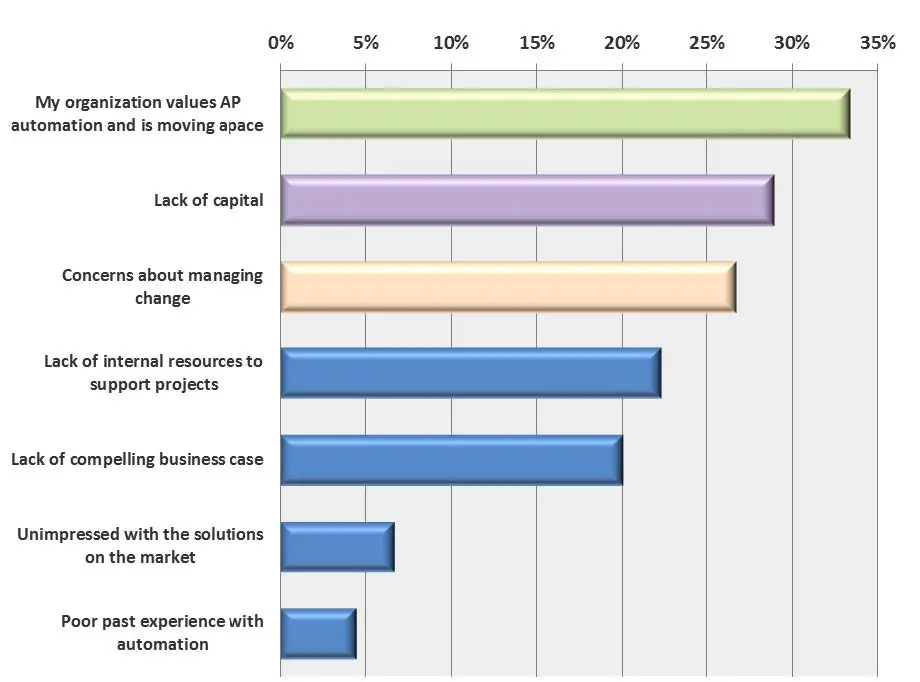

AP/AR Automation – Justifying the Cost

Not all organizations are convinced or able at this time to prioritize AP/AR automation technology. For organizations not moving forward with process improvement and process automation in finance, here are the top reasons why not:

- 33% of organizations are moving forward with AP automation

- 29% lack capital to get started with AP automation

- 23% lack internal resources to support the project

- 20% lack a compelling business Case

Finally, as with any departmental project in businesses, initiatives live and die by their ability to gain traction and support by peers and senior managers. The following factors were reported by respondents as most important to justify the cost of process improvement and intelligent automation solutions targeting finance:

- 46% Faster turnaround times

- 46% Higher accuracy/fewer mistakes

- 35% Better data capture

- 31% Lowering cost of processing AP transactions

- 20% FTE redeployments

- 15% better metrics to reduce exceptions

- 15% Mobile Access

- 13% Ensuring compliance

Conclusion and Recommendations

What is your company leaving on the table by not automating financial processes? Cost savings, increased visibility of automated payments processing, and simpler approval loops are possible by moving to paperless, automated systems for AP and AR processes. With machines to do the heavy lifting, the customer experience can be improved, and the labor force can be more adequately utilized through reassignment to more value added tasks - a mutual benefit to professionals and the business. In AIIM’s companion report Automating AP/AR Financial Processes – user feedback on the real ROI, AIIM analysts concluded the following:

“Businesses of all sizes are losing money and customer reputation due to slow and erroneous payment and collection processes, and yet AP – and particularly AR staff – are still hampered in their efforts by manual processes and poor access to all of the related case-documents, particularly those users working inside of ERP or accounting software systems with no direct links to content management and CRM systems2”

What is core to automating finance - and remains true as applied in any other business department, industry, or purpose undergoing process improvement - is how these automated systems deal with critical content. AIIM analyst Bob Larrivee addresses this concern aptly, “content without process goes nowhere; process without content serves no purpose.” To these ends, the automation of critical workflows in finance must be chiefly integrated with the vast range of financial content types and formats, financial systems like ERPs, and then delivered seamlessly to the process, the workflows, the designated users, and the automated machines.

While not every business is moving apace with intelligent process automation technologies as presented in our research findings, a large sum of them are committed to automating critical workflows in finance and accounting. With well proven benefits, it’s not an exaggeration to claim that going forward the future - a digital age - will demand better automation in business; the future is Robotic Process Automation (RPA), machine learning, AI, and intelligent process automation technologies. Organizations need to figure out how best to leverage these technologies for a competitive advantage, and they do this through a concerted effort of people, process, and technology.

To take your first step towards automating your finance department, here are best practices to help steer your process improvement project:

- Measure the number of invoices processed per month within your unit but also consider other parts of the organization.

- Calculate the current processing cost-per-invoice - then calculate potential savings with automation.

- Consider how automation granting better visibility of workloads, payment progress, and cash-flow prediction could improve invoice management and financial processes.

- Identify who is in charge of radical AP process review and seek endorsement for process improvement projects.

- Monitor elapsed time for processing and approvals, and identify where holdups and delays occur.

- Analyze the resource load of difficult cases and exceptions where access to additional documents is required or higher levels of approval are needed.

- Look at the handling of disputed payments more as a case-management exercise involving a folder of related documents and communications.

- Review how you are dealing with inquiries from suppliers regarding payment progress, and the impact that poor visibility of approval status and the lack of self-service portals may be having on AP staff - as well as on other parts of your business.

- Evaluate the flexibility of the AP/AR solution across other document-driven business processes.

- Consider how easily you can integrate the AP and AR systems with your existing content repositories, both for access during the process and auditable archive after the process.

- If you have developed AP and AR systems in-house, consider whether you are achieving the best possible performance by modern standards.

- Take account of your ability to integrate the AP/AR process with core systems.

- Establish a continuous improvement program that will periodically review and refine the AP process changes you make now.

References

Appendix 1

Survey Background and Demographics

The survey was conducted with a web-based tool collecting responses from 142 individual respondents who identify in the finance and accounting field. Responses were gathered between September 25th, 2017 and October 27th, 2017. Invitations to take the survey were sent via e-mail to a selection of the 193,000+ AIIM community members and qualified lists.

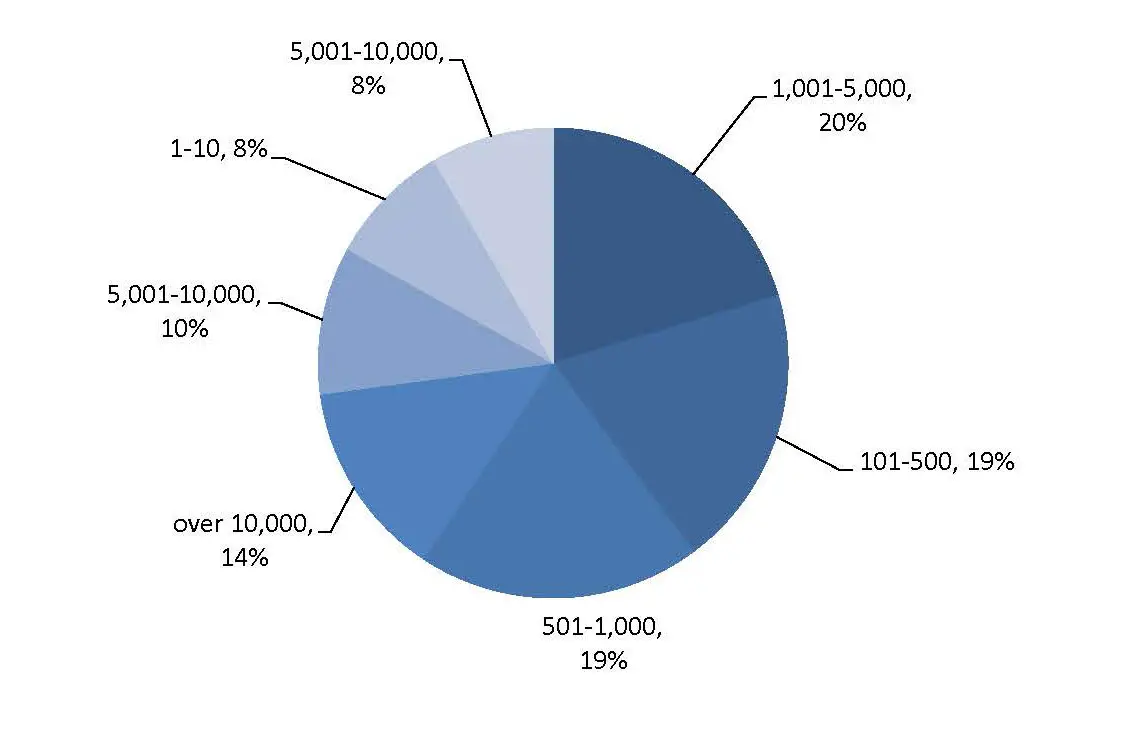

Organizational Size

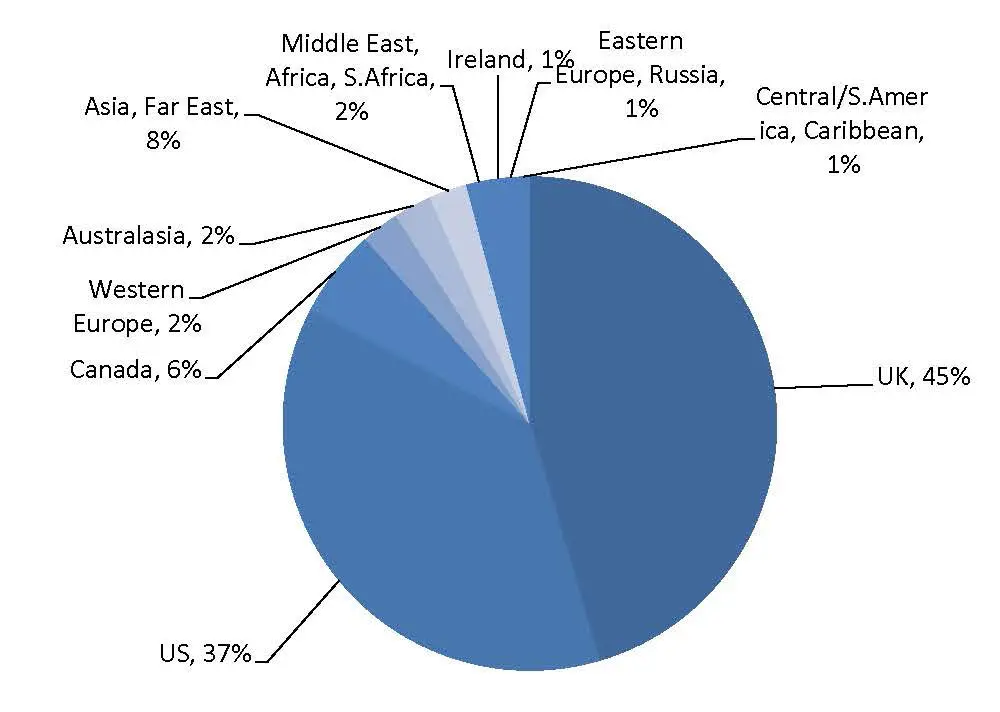

Geography

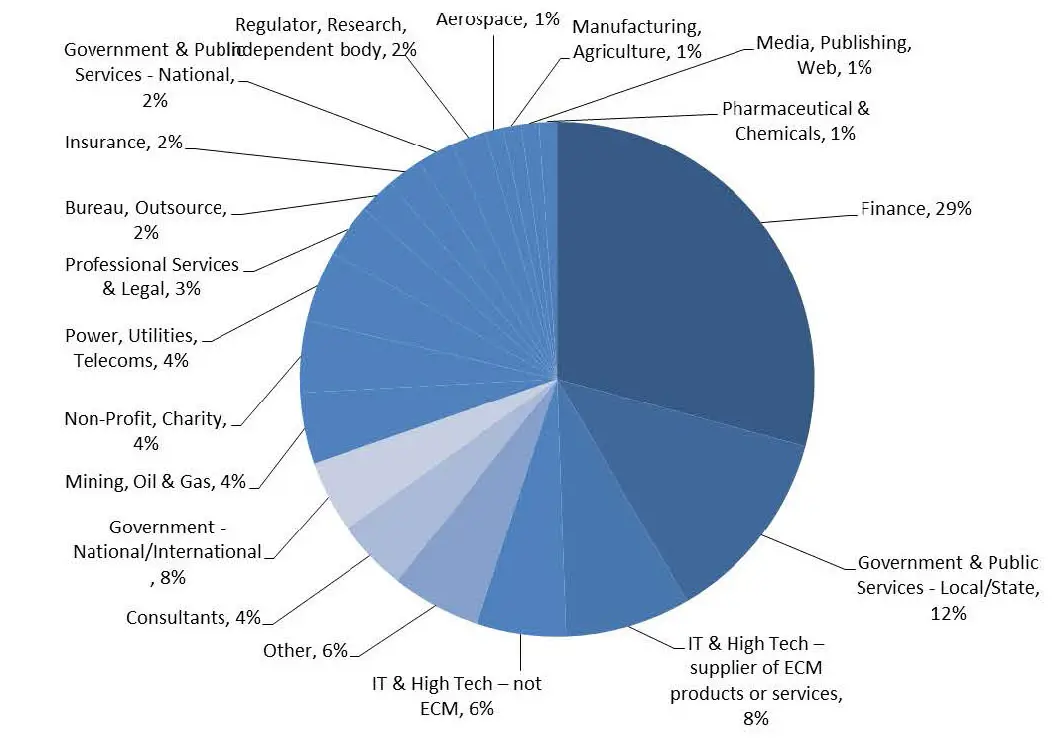

Industry

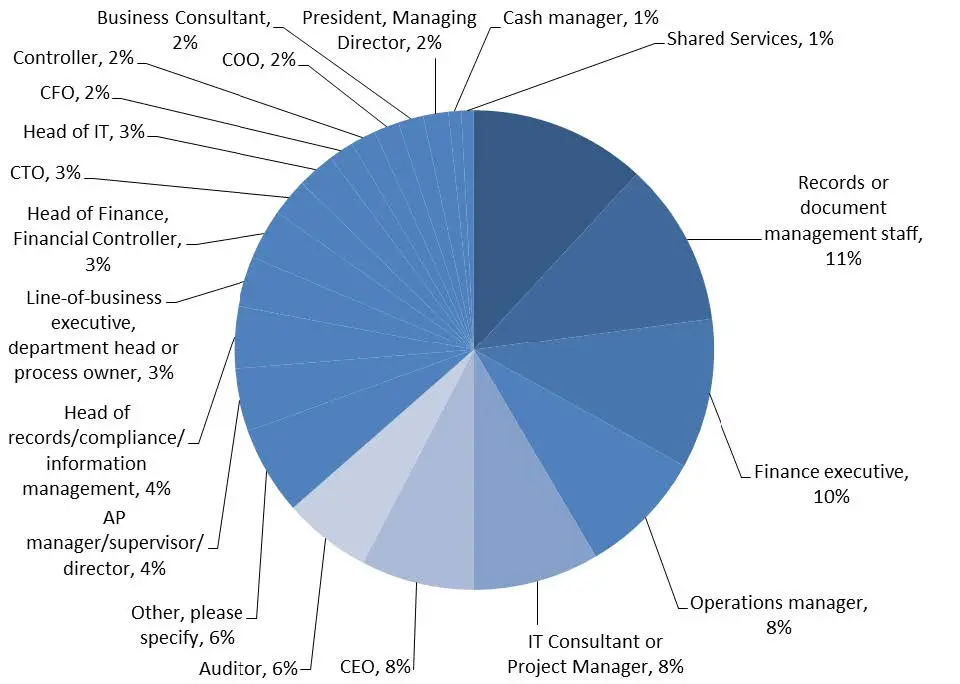

Job Roles

Artsyl

10-8707 Dufferin Street,

Suite # 111,

Vaughan,

ON L4J 0A6

Canada

Phone number: 905-326-0676

(301) 525-5405

About Artsyl

Artsyl Technologies, Inc. is dedicated to delivering digital transformation technologies and business process automation solutions. Artsyl solutions focus on the most painful and inefficient steps in the majority of business processes today - the entry of data and the filing of documents into ERP, ECM and other business systems.

Artsyl automates these manual processes by intelligently extracting relevant, actionable information from documents and electronic files in a way that boosts efficiency and accuracy.

Since 2002, the Artsyl team has successfully developed intelligent data capture and business process automation solutions for companies worldwide, quickly achieving a return on investment for our clients, leading to ongoing cost savings.

provides a foundation for process automation that allows organizations to intelligently extract data from existing documents and files, organize and manage that data and leverage that data to automate any business process.

docAlpha automatically captures, classifies and sorts large volumes of structured and semi-structured documents, extract useful data, validate data against their business rules, and route documents for approval. As part of the process, docAlpha can create or append related business records in ERPs, CRMs, ECMs or other business applications.

The docAlpha knowledgebase gathers the combined intelligence of all your docAlpha users to continuously improve and expand upon the types of documents it can read and process automatically.

Artsyl intelligent process automation applications, built on top of the docAlpha platform, provide easy-to-configure and implement solutions for common business processes.

By leveraging your digital AP documents, extracted transaction data and your business rules, Artsyl’s delivers a straight-through process that can take you all the way to the creation of the transaction in your ERP system.

For sales orders, the OrderAction application automates data extraction and intelligent document processing, helping to reduce days sales outstanding, boost customer satisfaction and deliver timely, detailed purchasing data.