Invoice Workflow Automation Report

Understanding the Use Case and Long-Term Value of an Automated Invoice Management Environment

Introduction

When it comes to exploring the benefits of an automated Accounts Payable (AP) process over a manual AP process, the case is fairly straightforward. Manual AP causes high processing costs, slow invoice approval times, frequent missed payments, weakened supplier relationships, and overall inefficient use of company resources. On the other hand, accounts payable automation reduces processing costs, lowers the number of missed payments, raises a company’s internal and external efficiency, and improves its bottom line. However, while there are millions of dollars’ worth of annual savings in the gap between a manual and automated accounts payable process, many companies leave those savings on the table. PayStream believes that this is because not every company is able to find the right accounts payable automation solution for their business needs.

AP automation is a general term that is used to encompass what is often a very complex process. It is true that for some companies, such as a small business with only a few hundred invoices a year, an automated accounts payable state is a relatively simple thing to define, map out, and achieve. But for larger companies with tens of thousands of invoices a year, a large supplier base, and a complicated business structure, automated accounts payable is much more difficult to imagine, much less attempt. These companies have numerous and complicated requirements for properly conducting invoice verification, validation, reviews, approvals, and payment. The complicated nature of their current state causes many companies to make excuses to avoid adopting invoice management automation software. They believe they are managing their own processes in a satisfactory way, and that the time, investment, and disruption involved in a software implementation would not be worth the risk.

Fortunately, software is available that is flexible and powerful enough to meet the needs of even the most complicated invoice management lifecycles. Invoice processing automation software is built to digitally manage an invoice throughout its lifecycle while offering flexibility and visibility. The solution can adjust to an AP department’s unique needs rather than forcing them to conform to the solution’s capabilities. AP automation software can also be implemented without major disruption to the current state, with ROI that is easy to predict and quick to achieve. This report explores leading AP automation solutions that offer advanced invoice processing workflow approval capabilities.

The Current State of AP

In order to identify invoice processing trends among North American organizations, PayStream surveyed over 400 back-office employees across several industries and market segments. The following data is taken from PayStream’s recent AP management survey.

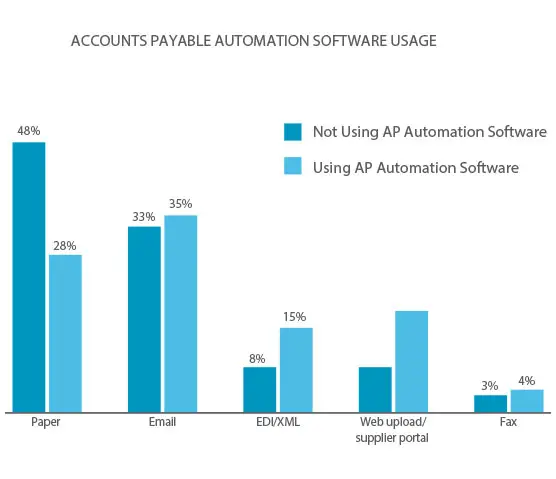

The first step in the invoice processing workflow - and often one of the greatest pain points - is invoice receipt. Trouble arises when companies receive the majority of their invoices outside of a centralized, digital system. The greatest examples of inefficient receipt types are paper, fax, and email invoices, although email is preferred to the first two types. The most efficient invoice types are electronic invoices (eInvoices) or those in EDI/XML format, and invoices submitted through a web-based, invoice processing software solution portal. Unfortunately, PayStream’s survey results show that for most AP departments, paper and email are the top two formats in which invoices are received, see Figure 1. However, results also show that if a company is using an AP automation software, it is more likely to be receiving invoices in digital formats.

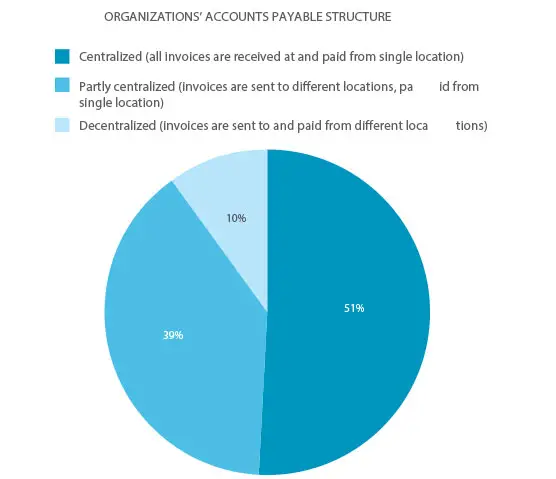

The movement and workflow of an invoice after receipt typically varies based on the way the company has structured its AP department and processes. Research also shows that about half of organizations have a fully centralized AP department, while 10 percent have completely decentralized departments, see Figure 2.

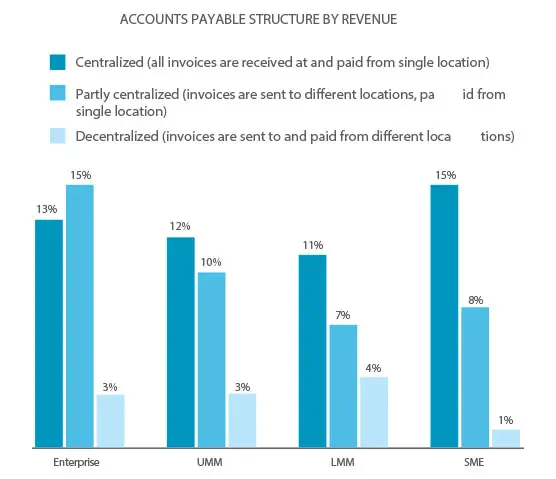

The structure of an organization’s AP process varies based on its size, see Figure 3. SMEs1 have the highest rate of centralized AP departments, as the lower number of invoices and spend in these companies makes it easier for them to receive and pay all invoices in one location. Organizations at the enterprise and UMM levels are somewhat less likely to be completely centralized than SMEs, but they are more likely to have partly centralized processes, where invoices are received at different offices but are paid by one entity. This is likely because larger-revenue organizations often have more resources and controls in place for managing back-office processes across widespread operations. In contrast, LMM organizations are most likely to have decentralized processes. This may be because their processes tend to rest between those in other market segments - they do not quite have the simplified AP state of SMEs, or the resources for controlled processes of larger companies.

1PayStream defines organizations with revenue greater than $2 billion as enterprises; organizations with revenue between $501 million and $2 billion as in the upper middle market (UMM); organizations with revenue between $101 million and $500 million as in the lower middle market (LMM); and organizations with revenue between $30 million and $100 million as SMEs

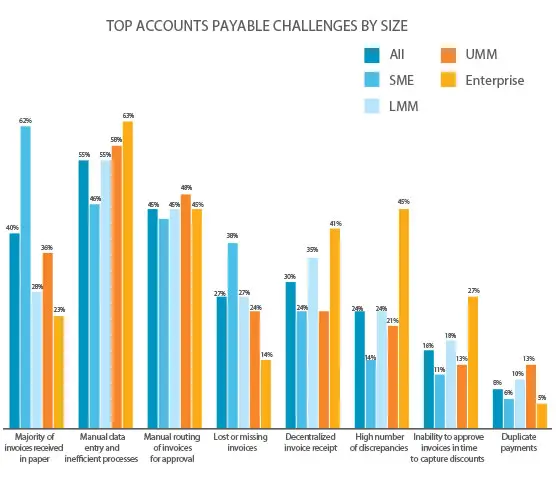

Invoice format, centralization, and company size are all factors that affect the workflow of an invoice within an organization after it is received, as well as the efficiency of that workflow. The invoice workflow can entail a complex and varied set of actions, including multiple levels of approvals, different rules relating to different types of invoices, and a large number of “touches” (points at which the invoice is reviewed or passed on at any point). Within the invoice lifecycle, many things can go wrong, and the less AP automation and centralization a company has achieved, the more issues arise. Research shows that today’s AP departments’ most common issues in invoice processing management are manual data entry and inefficient processes, manual routing of invoices, and high volumes of paper invoices, see Figure 4.

There were some variations in pain points across different revenue segments. SMEs’ problems are relatively straightforward - they report high volumes of paper invoices as their biggest pain point. However, as company revenues grow, the problems become more logistical. Both LMM and UMM companies report more issues related to invoice processing lifecycle management - such as inefficient data entry, routing issues, decentralized invoice receipt, and lost or missing invoices. Enterprises ranked a high number of discrepancies and exceptions as one of their highest pain points, which is likely caused by difficulty managing a large amount of data.

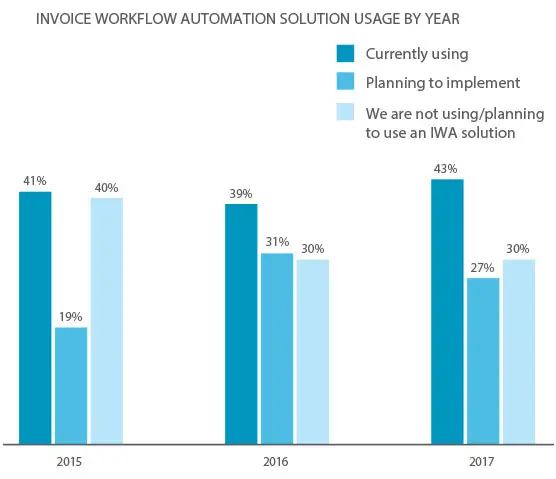

As many organizations’ AP process issues result from manual-related methods, one way to reduce these issues is to automate invoice processing management. Many companies have automated or have moved to the AP workflow automation process, and adoption/interest has grown steadily over the last few years, see Figure 5. However, 30 percent of respondents still are not using an AP invoice processing software solution.

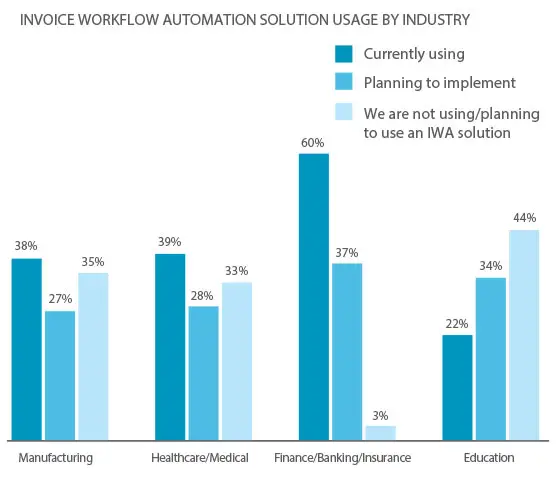

Some industries are more likely to implement an invoice processing workflow automation solution than others. For example, only 22 percent of education respondents report using an IWA solution, whereas 60 percent of finance/banking/insurance respondents have adopted an IWA software, see Figure 6.

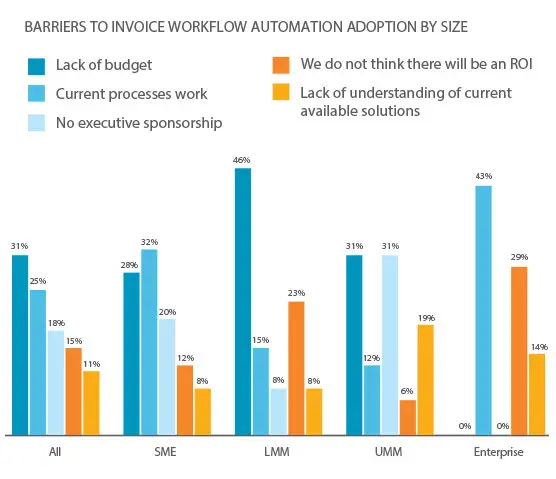

PayStream has found that the companies in finance/banking/insurance industries have historically been more progressive when it comes to back-office automation, and AP invoice processing software is no exception. On the other hand, education organizations are often behind when it comes to automating their financial processes, even though these companies typically have widespread operations that would benefit from a centralized accounts payable automation platform. Unfortunately, even though many organizations would benefit from workflow automation, they are often unwilling or unable to adopt a tool. Figure 7 shows the most common barriers to invoice processing software adoption. For most companies, it is a lack of budget or the belief that current processes are working that prevent them from automating. For companies in the UMM and LMM, a lack of budget and a fear that there will be no ROI are their largest concerns, while enterprise companies’ belief that current processes are working and fear of little ROI are the biggest barriers to adoption.

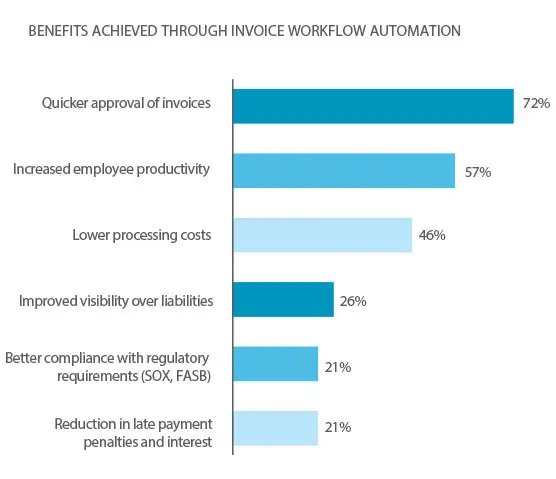

One of the ways to overcome adoption barriers is to educate top decision makers on the benefits of AP automation. Research shows that companies that adopt these solutions gain improvements in invoice approvals, employee productivity, and processing costs, see Figure 8. All these benefits can help to improve the bottom line and bring an ROI. Another way to show the value of AP automation is to use ROI calculators that help to estimate the monetary value of adopting an invoice processing automation solution. Readers can access these calculators in PayStream’s recent Pitching ROI report.

In order to educate organizations on the use case and value of workflow automation for AP invoice processing itself, the following section details the features, services, and benefits of IWA software.

Leading Supplier Management Software

An advanced AP automation solution is designed to adapt to existing business structures, diverse supplier bases, and complicated approval hierarchies. In order to meet these requirements, the software must address the entire invoice lifecycle and be highly advanced, customizable, and versatile.

Invoice Receipt

Before an approval workflow automation solution can operate successfully, invoices must be entered into the organization’s system in an efficient, timely, and accurate manner. There are two primary ways to input invoices into a workflow system electronically - through the use of a scanning and Optical Character Recognition (OCR) data capture process or via an eInvoicing network.

Optical Character Recognition (OCR) is the electronic conversion of scanned images or text to a machine-encoded document. OCR extracts the relevant data from scanned paper or PDF invoices and sends it through validation and routing. OCR technology can be used in several invoice receipt methods, including mailroom services, email extraction, and online portals.

After invoice data is extracted, the OCR-converted documents are verified against a set of validation rules; the solution compares specific fields against the information held in the appropriate back-end system (e.g., purchase order numbers against the purchasing system). Validation technology is a second round of checks and balances for invoice consistency and compliance - after the initial capture of data, it re-affirms the integrity of business documents before they are assimilated into the main workflow system.

The use of advanced OCR technology ensures a high level of precision, consistency, and compliance. Advanced OCR technology provides capture capabilities that have excellent pass-through rates when scanning paper documents, and some technologies can also extract data from the subject and body of emails, rather than from the attachments only. Some technologies can also read and extract data in several different languages. In all, the more advanced the OCR recognition software, the more streamlined the routing process becomes down the line.

Electronic invoice automation software eliminates all manual data entry by the buyer. There are three methods of electronic invoicing:

Traditional direct integration with the supplier’s back-end AR system, typically done via Electronic Data Interchange (EDI) of XML files.

Online fillable forms (usually as part of a supplier portal), which ensure that a uniform invoice is submitted every time.

Online fillable forms (usually as part of a supplier portal), which ensure that a uniform invoice is submitted every time.

A print-to-cloud solution that validates PDF elements instantly and notifies suppliers in real time if their invoice is missing necessary elements.

Advanced eInvoicing solutions are free for suppliers, and many feature advanced global capabilities for complex invoice processing requirements in Europe, Asia, and Latin America. The greatest advantage of AP automation is the ability to send invoices straight to the approver and then straight to payment (i.e., straight-through processing).

Matching and Routing

Workflow automation solutions enable AP departments to define how different types of invoices are processed. Invoice matching and routing involves linking invoices to purchase orders and other receiving documents, then sending them through the appropriate approval chain based on terms identified within the invoice (such as PO number). PO based invoices can be matched against PO and receipt documents automatically, while non-PO invoices are routed to the appropriate approvers.

All invoices are routed based on predefined business rules, and user roles and access rights can be set to match the organization’s existing approval hierarchy. Many solutions give client administrators control over individual user access rights. Those administrators can then delegate the types of approvals for each employee, their level of visibility, and their authorized dollar thresholds.

Advanced technologies provide field-level matching, meaning that they match specific characters in invoice line items with their counterparts in POs. Some solutions create notifications or workflows driven by fields with invalid or missing data, and some feature the ability to dictate workflows for non-PO invoices based on invoice contents.

Users may also assign non-PO invoices to categories within the general ledger, and advanced solutions allow specific line items to be assigned to multiple cost centers or multiple POs.

The accuracy of rules-based matching engines, in combination with invoice automation, allows many companies to automatically pay invoices that meet all validation rules shortly after receipt, letting AP staff focus only on exceptions. This pass-through feature can be used for low-value or recurring invoices (such as utility bills).

Invoices that fail validation and matching undergo a pre-established workflow and routing procedure, also called exception management. Invoice exceptions could be a discrepancy between an invoice and a PO or missing information such as PO number, approver’s name, or location code. The exception management process lets users reroute invoices and fix errors by viewing the original invoice to identify handwritten, printer, or OCR errors. Advanced exception management software allows for the creation of custom workflows depending on the type of exception present. These solutions also enable users to set thresholds for non-PO invoices to identify potential errors or fraud, such as an invoice for snow plow services in July. In addition, many systems put the responsibility of exception and discrepancy resolution back on suppliers, returning the document to them for correction before allowing it to enter the main workflow system.

Approval

Once invoices have been validated, matched, and routed into the appropriate queue, a variety of approval workflow automation capabilities ensure that those invoices are approved in a timely manner. Most invoice processing workflow automation solutions are highly configurable; they are built to adapt to an organization’s existing approval hierarchies and enable more complex routing (e.g., among different departments and cost centers). During and after initial setup of a solution, organizations can easily adjust workflows according to their own business rules, legal requirements, and the invoice type, amount, or other content. Advanced solutions facilitate this customization through visual workflow editors with detailed process flows and drag-and-drop functionality.

When invoices require review, approvers can typically be notified via email or mobile alerts. Most solutions come bundled with alerts and reminders for approvers, out-of-office delegation rules, and escalation procedures for overdue invoices. Prioritization capabilities allow organizations to move invoices with early payment discounts to the top of the processing queue, ensuring that they are approved in a timely manner. In addition, some solutions feature workload balancing features that redistribute the invoices in an approver’s queue to different employees if that approver’s workload exceeds a certain number of invoices.

AP interfaces make approvals easier and more transparent. Dashboards allow users to navigate in-progress invoices, providing complete histories of the documents. Supervisors can track the status of individual invoices or approvers, reorganize and prioritize unapproved invoices, and access audit trails at any time.

Some solutions offer approval capability directly from within emailed notifications; in other situations, users can click on a hyperlink in the email and log in to a system to view, code, and approve invoices online. Many solutions also offer mobile approval capability through native and/or responsive web-based apps. Offering multiple methods for approval keeps invoices moving through the system when approvers are on the go.

Automated accounts payable solutions greatly improve approval times through intelligent invoice routing and workflows, and through approval reminders and escalations. AP managers can also easily customize business rules and approval routes to separate high-priority invoices, such as those from a special supplier, ensuring that they are pushed to the top of approval queues.

Payment and Reconciliation

After an invoice has been approved, it is automatically sent forward to payment. Basic solutions create a payment file that is sent to the ERP (which then initiates payment or sends a message to AP). These solutions also facilitate the input of ACH information and integration with back-end AR systems.

To completely automate the invoice lifecycle, some solution providers offer an in-house or partner-provided electronic payments solution. For advanced solutions, this entails integration with virtual card solutions and active supplier onboarding services. Some solution providers even cut checks on behalf of the buyer if they fail to onboard suppliers to virtual cards or ACH.

Some accounts payable automation providers offer a web-pay portal for vendors to log in and view invoice and payment transaction status in real time. These portals can also support different payment types and automatic formatting of remittance information based on supplier preferences.

Reporting and Analytics

Most invoice processing software solutions combine process transparency with robust reporting and analytics tools, greatly improving an organization’s ability to audit, analyze, and improve procedures. Reports can be exported as spreadsheets, and can include first-pass success rates, exception rates, and open invoices for any defined period of time. Some solutions feature internal benchmarking, allowing users to review how their organization compares to other end-users of the solution. Leading solutions offer a drag-and-drop report building functionality and exceptional drill down capabilities from within a reporting dashboard.

Many AP automation systems also offer sophisticated invoice and payment audit technologies. Audit solutions can integrate seamlessly with numerous accounting applications, and can flag potential duplicates. Clients have the option of configuring the business logic that will be applied to identify erroneous payments, and the solutions generate reports on a periodic basis highlighting potential payment errors for resolution.

Supplier Management

One way to ensure the success of an AP automation initiative is to gain suppliers’ enthusiasm and ensure their participation in the solution. Many invoice automation software providers proactively engage their clients’ supplier communities in order to gain as much participation in the invoice management platform as possible. Some providers run large-scale onboarding campaigns, reaching out to suppliers via phone, email, and/or mail with invitations to join their network. These provider onboarding teams may also help the buying organization create invitation templates for its own outreach campaigns, as well as helping configure registration landing pages on the organization’s website.

Suppliers are also more likely to participate in workflow automation when the solution is supplier-focused - many of these tools offer valuable supplier self-service capabilities that speed up and streamline invoice processing. Supplier portals allow suppliers to upload invoices, check on the status of invoices, and communicate with buyers about exceptions and errors. Some solutions permit buyers to create custom business rules at the point of supplier portal invoice upload. These rules create instant error notifications and allow PO flip from within the portal. Some solutions also enable suppliers to input payment preferences, upload payment information, and verify payment information in real time. These portals also facilitate better supplier buyer communication and dispute resolution.

Working Capital Management

Some accounts payable automation solutions give organizations access to working capital management tools such as dynamic discounting, supply chain financing, and electronic payments such as virtual cards. These tools all increase companies’ savings and bottom line, either through sliding scale discounts, third-party financing, or payment rebates. Moreover, working capital management tools benefit the supplier through fast invoice payments, thus improving business relationships.

Mobility

Leading AP automation solutions provide their clients with dynamic mobile applications, allowing users to access business software tools from anywhere, at any time. Mobile access includes invoice verification and approvals, as well as communication with suppliers on invoices and payments. These applications are typically available through a responsive web app or a native application for mobile operating systems.

Things to Consider When Automating AP

In order to successfully choose and implement an invoice processing workflow automation solution, organizations should properly map out their current state. This means understanding the typical and atypical lifecycles of its invoices - all the elements that go into the fulfilment of an invoice, such as supplier characteristics, approval routing scenarios, budgets, and reporting requirements. Organizations should map out their current state for two reasons: first, they can use this detailed map to identify areas of improvement in current processes; second, they can use the map to help select the right invoice workflow automation provider.

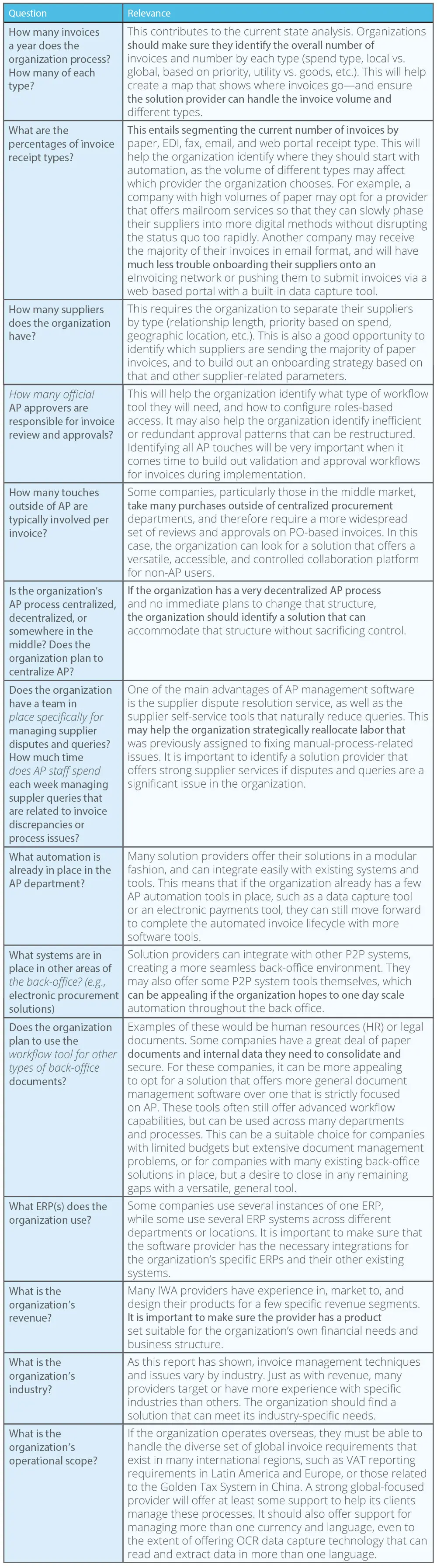

Below is a set of questions companies can use to help map out their current invoice management state, and prepare for an improved future state.

In order to help organizations select an invoice processing software solution, the following section explores the features and services of a leading AP automation software provider.

Artsyl

Artsyl has offered software for intelligent document capture, workflow automation, and invoice management for over 15 years, releasing its invoice solution, InvoiceAction, in 2013. Artsyl offers InvoiceAction along with its flagship product, docAlpha, a digital transformation platform, to enterprises of all sizes in a variety of industries, including shared services providers. The company helps clients process millions of documents each year across a variety of types, including invoices, medical claims, and government documents.

Solution Overview

Artsyl partners with Microsoft, and its products are developed using Microsoft .NET and Services Oriented Architecture; Artsyl has also adopted and follows all standard security models from Microsoft. Artsyl’s products leverage tight API-based integrations with major ERP systems such as SAP, Oracle/ArchWeb, Microsoft Dynamics, Acumatica, Sage 100/500, Sage Intacct, Epicor, and SYSPRO, and integrate with even more using EDI 810 and web services. InvoiceAction is available in English, French, German, Spanish, Chinese, and Russian. The product supports OCR data capture for over 100 languages including Arabic, Thai, Hebrew, Chinese, Japanese, Korean, and Vietnamese.

Invoice Management

InvoiceAction and docAlpha automate many of the most painful steps in invoice processing - manual data entry, approval routing, matching, and GL coding. Artsyl’s docAlpha solution can extract data from any digital or paper document with intelligent data capture technology, and leverages InvoiceAction to handle a specific business document flow - vendor invoice processing. docAlpha validates captured invoice data using its own algorithms and by cross-referencing information against clients’ ERPs or other business systems. docAlpha then applies business rules to extracted data to automate AP functions like approval routing and matching.

docAlpha allows for multi-channel submission of invoices via email, scanned paper, fax server, FTP site, WebDAV folders, and EDI. Artsyl supports PDF and other image formats such as TIFF, JPEG, BMP, and PNG, or electronic invoice formats such as EDI, XML, TXT, CSV, Word, and Excel. Artsyl also offers a supplier portal that gives suppliers direct invoice submission/generation capabilities for multiple formats (EDI, PO flip, web forms, etc.), as well as the ability to view and monitor invoices in progress.

InvoiceAction extracts relevant header and line item data from invoices and related procurement documents, validating that data by cross referencing existing ERP system records. InvoiceAction then relies on that data to provide 3- and 4-way matching with transactions within the ERP system, or automatic exception routing according to pre-defined business rules. InvoiceAction supports field-level matching based on business rules, and invoices can be routed back to suppliers with rejection explanations.

Automatic email notifications alert staff to exceptions that need attention, and automatic escalations ensure that nothing remains in any individual’s queue for too long. InvoiceAction supports out-of-office forwarding, escalations and reminders, and workload balancing. The solution also offers automatic approvals on recurring invoices, such as utility bills. InvoiceAction is web-based, and its responsive-design application can be accessed from any mobile device. Emails contain hyperlinks to launch the application and allow users to manage their invoices from any tablet or mobile device.

Artsyl can store invoices in file servers and enterprise content management (ECM) systems for later search and retrieval. The company also supports SharePoint and leverages content management interoperability services (CMIS) for content connectivity with other major ECM systems.

Artsyl’s solutions use a transaction statistics server to collect and report on all facets of any transaction processed through the system. The solutions offer reports that can be configured to present all possible KPIs for a client. Artsyl’s consulting staff works with all clients to map out the current processes and re-engineer them leveraging docAlpha and InvoiceAction’s features.

Implementation and Pricing

A typical implementation can range from a few days to a few months depending on its complexity. The software is available for on premise, hosted, or public Cloud deployment. Artsyl provides full operator and administrator training as part of the standard implementation. After implementation, Artsyl offers full technical support 24 hours per day, Monday through Friday.

InvoiceAction is priced per transaction and will be available as a subscription.

About PayStream Advisors

PayStream Advisors is a research and advisory firm focused on business process automation in sourcing, supply chain management, procurement, accounts payable, payments, and expense management. PayStream’s team of experts provide targeted research and consulting services to address the changing needs of finance and procurement professionals. In short, PayStream is dedicated to maximizing returns and minimizing risks associated with technology investment. PayStream’s research reports, white papers, webinars, and tools are available free of charge at www.paystreamadvisors.com. PayStream Advisors is a division of Levvel, an IT consulting firm specializing in technology strategy, design, architecture, and DevOps.