Why Small Businesses Struggle More With Cash Flow Than Big Corporations

Money moving in and out of a business tells the real story of survival. For small firms, that story often feels unpredictable. A late payment from one client or a supplier demanding cash up front can shake stability overnight.

Use InvoiceAction to automate invoice processing, speed up approvals, capture early payment discounts, and free up working capital. AI-powered AP automation keeps your cash flow moving.

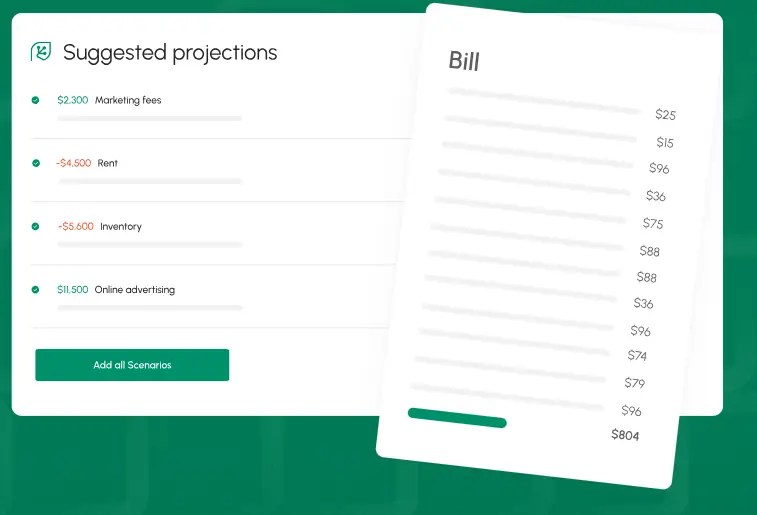

Large corporations face similar patterns, but their resources cushion the blows. The contrast makes small business cash flow a challenge of survival, where each decision around money feels critical. Many turn to cash flow management software to track every dollar and highlight the risks earlier.

Recommended reading: Strategies for Reducing Accounts Receivable and Boosting Cash Flow

Small companies walk into the marketplace without the financial safety nets available to giants. A bakery on the corner may depend on a bank loan with a steep interest rate, while a multinational chain negotiates billion-dollar credit lines at favorable terms. That difference dictates breathing room.

Large corporations stretch costs across thousands of sales and dozens of divisions. Small operators cannot. Rent, payroll, and insurance weigh heavily when divided by a narrow stream of income. To a corporation, a 5 percent slowdown is a hairline crack in the wall. To a small firm, it is water rushing through the ceiling.

Access to reserves separates the two worlds even more. Global companies hold investment portfolios and cash on hand. Small businesses rarely keep a cushion for more than a few weeks. When suppliers seek cash in advance, big players negotiate on their terms.

Transform Document Chaos Into Cash Flow Control

See how docAlpha uses intelligent automation to process diverse document types, structured or unstructured, and keep your AP workflows running smoothly.

Book a demo now

Everyday tasks hide traps that small businesses struggle to navigate. Invoices waiting for client approval tie up money. A subcontractor may complete a project in January but wait until March to see payment. That delay leaves payroll hanging in the balance. Large corporations collect from hundreds of customers and withstand delays with little disruption.

Inventory shows another hidden drain. A small clothing shop may purchase bulk stock to meet supplier minimums, locking thousands of dollars into racks of fabric. Without steady sales, cash gets buried in unsold stock. Larger competitors rely on advanced software to forecast demand and avoid excess purchases.

Fixed costs create additional strain. Seasonal spikes or unexpected license renewals feel heavy when revenue barely covers daily expenses. Corporate systems account for those costs months ahead. A family business often discovers them only when bills arrive.

BOOST ORDER-TO-CASH SPEED AND ACCURACY

Struggling with late customer payments? OrderAction helps you automate sales order entry, reducing manual bottlenecks and accelerating

incoming cash flow.

Book a demo now

Behind every small business cash flow crisis sits a pattern of financial habits. Owners wear the hats of marketer, seller, service rep, and bookkeeper all at once. Specialist knowledge gets lost in the shuffle. Large corporations appoint chief financial officers, treasury teams, and analysts focused only on liquidity.

Recommended reading: How AP Automation Transforms Cash Flow Management

Planning reflects this gap. Large companies update rolling forecasts every quarter, preparing for multiple outcomes. Small firms often respond after the problem arrives, borrowing at the last moment through high-interest credit cards or short-term loans. That cycle repeats until debt consumes profits.

Taxes add another sudden drain. Small businesses miscalculate quarterly obligations more frequently. A surprise tax charge depletes funds and sends owners scrambling for loans. Large corporations manage timing with precision across subsidiaries.

Stop Leaking Cash - Automate Your Invoice Approvals Manual AP processes drain small businesses. With InvoiceAction, you can capture, route, and approve invoices faster, improving working capital

and supplier relationships.

Book a demo now

The marketplace applies pressure unevenly. Customers of small businesses react strongly to even modest price increases. A coffee shop raising prices by fifty cents risks losing its morning crowd. Global chains spread increases across regions with little impact on loyalty.

Inflation magnifies cash flow challenges. Higher wages, steeper fuel bills, and pricier materials eat into their limited cash. Large companies can hedge costs or buy in massive quantities. Small firms take the increase head-on, with no buffer and no shortcuts.

Revenue concentration deepens fragility. A design studio, depending on two large clients, faces severe risk if one delays or cancels a project. Economic shocks highlight these contrasts. During downturns, corporations shift focus to stronger divisions, while many small firms close their doors within months.

Recommended reading: Tips to Master Cash Flow Management and Boost Your Business

Small businesses can strengthen their footing through deliberate strategy. Steps that make a difference include:

The financing strategy needs particular attention. Accessing capital through planned tools keeps working funds flowing and prevents the spiral of reactive borrowing. These small adjustments accumulate into greater resilience.

Automate Sales Orders And Free Up Cash Faster Delays in sales order entry can stall revenue. OrderAction solves this with AI-powered automation, helping your small business move money faster.

Book a demo now

Small businesses stumble on cash flow because they run lean, without the scale or leverage that cushions the big players. Every delayed payment, every supplier demand, every economic shift hits them harder.

Overcoming cash flow challenges takes discipline and the right tools. Cash Flow Frog turns complex numbers into clear insights. Try it today and share your thoughts below.

Recommended reading: How Cash Flow Management Software Helps You Stay Profitable