Getting Your AP Automation Project Off the Ground

To get executive sponsorship, think and communicate like an executive

In this multi-part Blog Series, we’ll look at how companies can transform their AP operations from a back office function to a strategic asset that can boost productivity, profitability and innovation beyond AP and Finance. Our second blog in this series explores the responsibilities of an AP automation project leader and how to get buy-in from an executive sponsor.

While the productivity gains that can be achieved from AP automation are well documented, with relatively minimal risk, AP teams have not always been able to make a winning case for investing in innovation for their operations.

A recent study from PayStream Advisors, sponsored by Artsyl, shows that the top barriers to AP automation adoption include:

- The belief that current processes are working;

- A belief that there will be no Return on Investment (ROI) from a solution;

- A failure to gain internal buy-in.

Communicating Problems, Solutions and Benefits

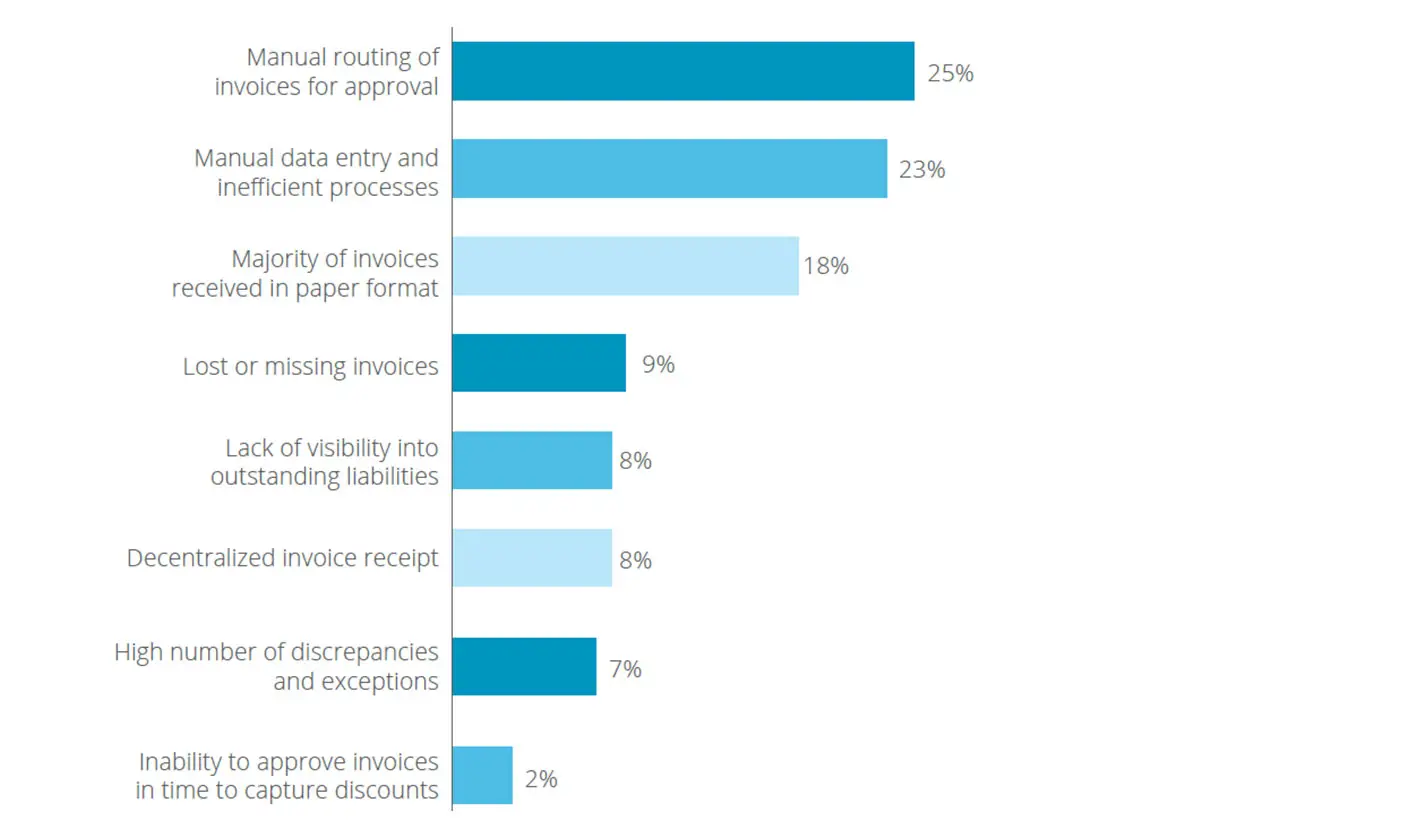

In the first part of our Blog series, we discussed the primary pains experienced by organizations that still rely on manual processes to manage sorting/filing invoices, routing documents for approval and entering data into ERP systems. These symptoms included long approval cycles, high error rates, a low % of early payment discounts and lack of time/accurate data to better predict and manage cash flow.

The results of Paystream Advisor’s surveys demonstrate similar results:

Source: Paystream Advisors

Source: Paystream Advisors

Think and Communicate Like an Executive

The problem with conveying these challenges the sub-optimized results that AP departments may experience, is that do not tie back to specific corporate key performance indicators (KPIs) and objectives. To translate these department-level pains into company-level concerns, AP Managers and staff need to think further downstream to the financial impact to the organization as a whole and to the impact on specific strategic objectives.

Think about each of the departmental issues above as they relate to corporate goals:

- Manual data entry leads to a lack of process visibility and a higher number of errors and exceptions that results in inaccurate data. This could lead to poor forecasting for cash flow and other KPIs that are critical to your CFO, COO and CEO.

- Lost or missing invoices can lead to increased costs, but it could also create compliance risks that could potentially have even greater impact to the organization

- The inability to capture early payment discounts ALSO speaks to a lack of process visibility and control that could have an impact on cash flow, compliance and control

These are just a few examples, but when looking at the departmental issues and risks, think about how to translate those pains into BOTH quantitative and qualitative impacts on the financial health of the company, potential compliance risks/issues and risks to the company’s reputation or relationships with key vendors, suppliers, partners and customers.

Target Your Executive Sponsor and Be SPECIFIC About Your Needs

If gathering all the right metrics and making perfect business case to a decision maker seems daunting, start by documenting and defining your departmental pains in as much detail as you can, then discuss them with a potential executive sponsor to discuss company priorities and the risks/benefits of automating your AP processes with them.

You may discover that the information and the data you’re looking for is already available - or that multiple stakeholders may hold different pieces of the puzzle when defining your problems and quantifying goals and potential benefits. Those same people may become key members of your planning and implementation team.

Once you’ve gathered the information you need to make a business case that aligns with executive priorities, make sure that you clearly define what investment in time, money and resources you need for the initiative and how spending those resources will lead to specific improvements in corporate-level results.

Initially, that may simply mean getting buy-in to explore an initiative, with approval to allocate specific staff time to put a proposal together. Or, it may mean getting buy-in on executing a proposal that has clearly laid out budgets, ROI and timelines.

In our NEXT AP Automation Blog, we’ll explore tips for gathering requirements for process automation initiative and mapping out your new automated process in detail.