ROI is a buzzword that gets tossed around a lot in the world of business and finance. But what exactly is ROI, and why does it matter? Simply put, ROI (return-on-investment) is a measurement that indicates how much profit or loss an investment has generated, relative to the amount of money that was invested in it.

Key Takeaways

Let’s explore the basics of ROI and why it’s essential to understand it as a business owner or investor.

Transform your financial operations with Artsyl’s AP Automation.

Embrace the future of accounting and watch your ROI soar as you eliminate manual errors, reduce processing times, and unlock strategic insights. Don’t just manage your accounts payable — revolutionize them with InvoiceAction.

The Growing Role of ROI

In today’s business climate, Return on Investment, or ROI, has become more important than ever. It’s not enough for businesses to simply invest, they must also make sure that these investments are profitable and generate substantial returns.

ROI is a crucial metric that measures the effectiveness of a business strategy or investment, and it helps decision-makers determine if a particular venture is worth pursuing in the long run or not. Ignoring ROI or paying little attention to it can lead to significant losses for a company, and it could jeopardize its financial stability and sustainability.

Therefore, having a good understanding of ROI and its importance is essential for any business looking to thrive in today’s dynamic and competitive market.

Intelligent Process Automation Solution

Related Videos

Showcasing ROI Across Different Industries

While ROI is calculated in terms of financial gains, it can also include non-financial aspects such as efficiency, customer satisfaction, and employee retention. With the world being a competition, almost every industry is on a constant lookout for innovative ways to increase ROI.

Healthcare Industry ROI

The healthcare industry is a prime example of how companies are focused on ROI. A study showed that if a hospital invests around $1 in a patient experience, it will receive a return of around $4 per patient.

Customer satisfaction and experience are crucial elements of ROI in healthcare. By providing exceptional patient care, satisfaction rates are higher, and return visits and referrals are more likely. Investing in healthcare IT systems has also led to increased patient outcomes while being more cost-effective for hospitals.

RELATED: Accounts Payable vs Accounts Receivable: What is the Difference?

Retail Industry ROI

In the retail industry, ROI is all about profit margins. Retailers need to make sure they are profitable to facilitate growth. One of the most effective ways to increase ROI in the retail industry is by using customer data to improve the shopping experience.

For example, companies can use Big Data and Analytic systems to identify customer shopping patterns. This data can be used to segment the audience and identify who spends more, or what products are more popular in specific regions.

This allows the business to tailor their marketing strategies to a specific group of customers, which inevitably leads to an increase in sales, and consequently, profits.

Manufacturing Industry ROI

The manufacturing industry deals primarily with producing goods that are sold to consumers. ROI in this industry is all about optimizing the production process to increase profit margins. One of the ways that the manufacturing industry increases ROI is by reducing production time.

This is achieved by reconfiguring the manufacturing process and reducing the labor required to complete it. Manufacturing companies are also using automation and artificial intelligence to reduce the time it takes to produce items while minimizing error rates.

Education Industry ROI

ROI is a crucial aspect of the education industry. Students need to be confident that their investment of time, money, and effort will lead to job opportunities after graduation. ROI in the education industry tends to focus on improving student outcomes.

One of the ways this is being achieved is through the use of technology in the classroom. For example, schools can use learning management systems, which allow teachers to monitor student activity and progress. They can then analyze the data and tailor their teaching strategies to ensure that students are getting the most out of their educational experience.

Entertainment Industry ROI

In the entertainment industry, ROI is measured in TV viewership, streams, and ticket sales. To increase ROI, companies in the entertainment industry must continue to produce content that viewers want to see. However, simply producing content is not enough. Content distribution is also crucial, so companies can now track and analyze customer behavior and engagement and tailor a marketing strategy around it.

For example, Spotify uses AI algorithms to suggest the best songs for customers as per their music taste. Through this, Spotify ensures that customers keep coming back, which ultimately leads to an increase in ROI.

Measuring ROI is an integral part of different industries. ROI can be calculated in financial gains or other non-financial aspects of the business. Across various industries, companies are achieving ROI through improving customer experience and outcomes, optimizing production processes, and improving marketing strategies.

One of the surefire ways to lower ROI is manual document handling. Maximize ROI with Artsyl’s intelligent order processing. Harness the power of AI to automate data extraction and streamline your workflows. Experience a remarkable increase in productivity and a significant boost in ROI.

Book a demo now

What is Good ROI?

When it comes to investments, everyone wants to make sure they’re getting a good return on their investment, or ROI. But what exactly defines a «good» ROI? Is it a certain percentage above the initial investment, or is it more subjective depending on the individual and their goals?

Some may argue that a 10% ROI is great while others may hold out for a 50% ROI. Ultimately, defining a good ROI will vary from person to person and situation to situation.

It’s important to consider factors such as time-frame, risk tolerance, and individual financial goals when determining what ROI is considered successful and worth pursuing.

ROI Strategies: ROI Optimization

Return on Investment (ROI) optimization is crucial for any business to thrive. Here are several strategies to consider.

Optimize Cost Management

Regularly review and adjust budgets to reduce unnecessary expenditures. Seek cost-effective alternatives for essential services and supplies.

Enhance Customer Experience

A good strategy is to invest in customer service training and technologies. You can also consider personalizing customer interactions to build loyalty and encourage repeat business.

Focus on High-ROI Marketing:

Businesses can utilize data analytics to identify the most effective marketing channels while allocating more resources to high-performing channels and campaigns.

Leverage Technology and Automation

Investing in technology helps automate repetitive tasks, saving time and resources. Also, using AI and machine learning tools for data analysis, forecasting, and decision-making is a smart ROI boosting strategy.

Expand into New Markets

Research and identify new market opportunities for your products or services. This helps to diversify product offerings and appeal to a broader customer base.

Enhance Productivity and Efficiency

Implementing project management tools and methodologies along with encouraging employee training and development to improve skills and efficiency is a good ROI strategy.

Streamline Supply Chain Operations

Optimize inventory management to reduce carrying costs. This also helps build strong relationships with suppliers for better pricing and reliability. A part of this strategy is to form alliances with complementary businesses for mutual benefit. You can also collaborate on marketing or product development to share costs and resources.

Each of these strategies requires a tailored approach based on your business’s specific needs and goals. Regular analysis and adaptation are key to maximizing ROI effectively.

Elevate your inventory management with Artsyl’s Intelligent Data Capture. Unlock the potential of accurate, real-time data processing, reducing overstock and stockouts with docAlpha. Watch your ROI grow as you optimize inventory levels and improve operational efficiency.

Book a demo now

ROI Calculator: How to Determine ROI

Creating a basic Return on Investment (ROI) calculator involves a simple formula, but it can be adjusted to fit more specific requirements. Here’s a general approach to calculating ROI:

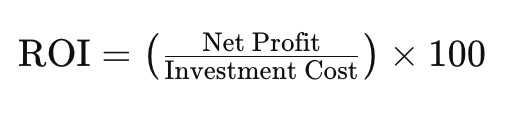

The basic formula for ROI is:

Where:

- Net Profit is the revenue generated from the investment minus the cost of the investment.

- Investment Cost is the total amount spent on the investment.

Steps to Calculate ROI

- Determine the total revenue: This is the income generated from the investment. For instance, this could be sales revenue from a marketing campaign.

- Calculate the total cost of investment: This includes all expenses related to the investment, such as marketing expenses, operational costs, etc.

- Compute net profit: Subtract the total cost of investment from the total revenue.

- Apply the ROI formula: Use the net profit and the total cost of investment in the formula to calculate ROI.

Example of ROI Calculation

Suppose you spent £5,000 on a marketing campaign and generated £15,000 in sales from this campaign.

- Total Revenue: $15,000

- Total Cost of Investment: $5,000

- Net Profit: $15,000 — $5,000 = $10,000

- For the ROI calculation, take the net profit of $10,000, divide it by the investment cost of $5,000, and then multiply by 100. This gives you an ROI of 200%.

What does this mean? The ROI for the marketing campaign is 200%, indicating a significant return on the investment.

RELATED: Utilizing Microsoft ERP and OCR for Document Processing: Optimizing Efficiency and Accuracy

Customizing Your ROI Calculator

For a more customized ROI calculator, consider the following adjustments:

- Segmentation of costs and revenues: Break down costs and revenues into more specific categories for detailed analysis.

- Time factor: Include the time period over which the ROI is calculated, especially for long-term investments.

- Risk adjustments: If applicable, adjust for the risk associated with the investment.

An Excel spreadsheet or a specialized software tool can be used to create a more sophisticated ROI calculator that includes these additional factors.

Take your order processing to the next level with Artsyl’s OrderAction. Speed up order fulfillment, enhance customer satisfaction, and see a remarkable improvement in ROI. With With automated data capture and intelligent processing, watch as your order management becomes a seamless, efficient engine driving your business forward.

Book a demo now

Key ROI Terms Explained

What is ROI?

ROI, or return on investment, is a critical metric for businesses and investors alike. Essentially, ROI measures how much value or profit is generated from investment dollars. It’s a way of determining whether an investment is worth making or not.

For example, if a company invests $10,000 in a marketing campaign and generates $15,000 in revenue, the ROI is 50%. This means that for every dollar invested, the company earned 50 cents in return.

Understanding ROI meaning is essential for making smarter investment decisions, prioritizing investments for maximum impact, and measuring the success of your efforts. Ultimately, knowing your ROI meaning can help you make more money, save resources, and allocate resources smartly.

What Does ROI Stand For?

ROI stands for return on investment, which is a measure used to evaluate the efficiency and profitability of an investment. Essentially, it helps you determine if the money you put into an endeavor is worth the outcome you received.

ROI can be calculated for a variety of investments, such as marketing campaigns, equipment purchases, or real estate ventures. By tracking the ROI of different investments, you can make sound financial choices and see real value from your expenditures.

Why ROI is Important

ROI is an essential metric for business owners and investors because it helps them understand the effectiveness of their investments. ROI can indicate whether an investment is successful or not, and provide insight on how to adjust strategies or decision-making. Additionally, ROI can help investors compare investments and make informed decisions on where to allocate their funds.

At the same time, ROI alone does not provide all the information needed to make investment decisions. ROI ignores the potential for risk and external factors that can affect returns, such as market fluctuations and economic shifts.

It’s crucial to understand that ROI is just one metric, and investors should consider a range of financial and non-financial factors before making investment decisions.

How to Calculate ROI?

Firstly, it’s important to understand how ROI is calculated. The formula for ROI is [(Gain from Investment — Cost of Investment)/Cost of Investment] x 100.

For example, if you invested $10,000 in a business venture and earned $12,000 in profits, your ROI would be ((12,000-10,000)/10,000) x 100 = 20%. The higher the percentage, the more profitable the investment is.

Types of ROI

There are different types of ROI, each with a unique perspective on investment returns. For example, there is cash-on-cash ROI, which compares the annual return on an investment to the amount of cash invested.

There is also total ROI, which considers all return sources (such as revenue, profits, and asset appreciation) and compares them to the amount invested.

Understanding the different types of ROI can help investors make more informed decisions about their investments.

Reimagine payment processing with ArtsylPay. Accept and send seamless, efficient, and memorable smooth payments that build lasting customer relationships. Boost your ROI by enhancing customer satisfaction and loyalty. Let Artsyl pave the way to a more engaging and profitable customer journey!

Book a demo now

Final Thoughts: Strategies for Maximizing ROI

In conclusion, ROI is a crucial metric for business owners and investors to understand because it provides insight into the results of their investments. By calculating and analyzing ROI, investors can make more informed decisions on where to allocate their funds and how to adjust their strategies for optimal returns. Additionally, investors should consider a range of factors beyond just ROI when making investment decisions, such as risk and external market factors. Understanding ROI is one step towards making profitable investment decisions that benefit both the investor and the business venture.

FAQ

Can ROI be negative?

Yes, ROI can be negative. A negative ROI indicates that the investment has lost money, as the costs outweigh the returns.

Is a higher ROI always better?

Generally, a higher ROI is desirable as it indicates a more profitable investment. However, it’s important to also consider other factors like risk, the time frame of the investment, and overall business objectives.

How do I improve my ROI?

Improving ROI can involve reducing costs, increasing the efficiency of operations, focusing on high-return marketing strategies, and making data-driven investment decisions.

Does ROI take time into account?

The basic ROI formula does not factor in time. However, for long-term investments, it’s important to consider the time value of money. Adjusted ROI metrics, like the annualized ROI, can provide a more accurate picture over time.

Is ROI applicable in non-financial scenarios?

Yes, ROI can be adapted to measure the return on non-financial investments, such as employee training programs, by quantifying the benefits in financial terms.

How does ROI differ from profit margin?

ROI measures the efficiency of an investment relative to its cost, while profit margin measures how much of every dollar in sales a company keeps in earnings. ROI is a ratio or percentage, whereas profit margin is expressed as a percentage of sales.

Can ROI be used for comparing different types of investments?

Yes, ROI is a versatile metric that can be used to compare the returns from different types of investments, whether they are financial, capital, or even marketing investments.

Why Invest in Intelligent Process Automation?

Why Invest in Intelligent Process Automation? Utilizing Microsoft ERP and OCR for Document Processing: Optimizing Efficiency and Accuracy

Utilizing Microsoft ERP and OCR for Document Processing: Optimizing Efficiency and Accuracy Nurturing an Engaging Workforce

Nurturing an Engaging Workforce Accounts Payable vs Accounts Receivable: What is the Difference?

Accounts Payable vs Accounts Receivable: What is the Difference? Document Processing Software for ERPs

Document Processing Software for ERPs Unravelling the Decision-Making Process in Accounts Payable Automation

Unravelling the Decision-Making Process in Accounts Payable Automation