Invoice management is an essential aspect of running a successful business. It involves creating, sending, and tracking invoices and payment receipts. Proper invoice management can help you avoid late payments, reduce the risk of fraud, and save time and resources.

Managing invoices can be a challenging task, especially for small business owners who have limited resources. In this guide, we will discuss everything you need to know about invoice management and how you can streamline the process for your business.

Don’t let the invoice backlog bog down your business. With Artsyl InvoiceAction, you can streamline your entire invoice management process, from capture to payment. Unlock the future of

accounts payable today!

Book a demo now

The Importance of Invoice Management: What Business Owners Should Know

Keeping track of multiple invoices, bills, and payments can be a challenge, but neglecting invoices can lead to confusion and financial losses.

One of the main reasons why proper invoice management is crucial is to keep your business organized. By implementing an efficient invoice management system, you can track all your invoices in one place, making it easy to access, monitor, and manage them.

Getting rid of misplaced or lost invoices means ensuring that payments are collected promptly, and there is no delay in the delivery of goods or services.

Invoice Automation Software

Related Videos

Improve Financial Control Over Your Business

Invoice management can also increase financial control over your business. If you keep track of all your invoices, you can generate reports that help you understand your business cash flow, expenses, and where you need to allocate your resources. Regularly reviewing this information can help you make informed decisions about your business finances. By having a transparent view of your cash flow, you can continuously improve your overall finances and lead your organization towards more profitability.

Better Client Communication

Implementing proper invoice management can also lead to better communication with your clients. Prompt invoice delivery and payment processing not only enhance customer experience, but it also strengthens customer relationships. It sends a message to clients that you are a reliable business owner and that you value their payment. Additionally, if there are any delays or complications with the payment process, it is essential to communicate with clients and find a resolution promptly.

Avoid Losing Money and Time

Incorrect, missing, or late invoice can have severe consequences on your business. It can lead to financial losses, customer complaints, and even legal disputes.

By implementing an efficient invoice management system, you can avoid these errors and inefficiencies, which ultimately saves your time and money. The time that you would have spent fixing errors can now be spent on more valuable activities that drive your business.

Record Keeping and Compliance

Proper invoice management also ensures compliance with tax regulations and record keeping laws. It is crucial to have all your invoices properly recorded and backed up to protect your business and avoid lawsuits or penalties resulting from a lack of compliance. In addition, regular record-keeping can help in audits, which can be valuable in improving your business operations.

As you can see, invoice management is a critical aspect of any business, regardless of size or industry. It helps you stay organized, enhances financial control, improves communication with clients, saves time and money, and provides compliance with tax and record-keeping regulations.

By implementing efficient invoice management strategies, you can reduce errors, increase productivity and profitability, and lead your business on a path towards success.

Cut costs and improve accuracy with Artsyl docAlpha intelligent financial documentation management system. Empower your team to focus on strategic tasks instead of manual data entry. Request a free personalized

demo to discover how!

Book a demo now

The Basics of Invoice Management

Invoice management is a crucial part of any business’s financial operations, serving as the gateway through which revenue flows. This process encompasses the receipt, tracking, and payment of supplier invoices. It’s about far more than just paying bills; effective invoice management can influence a company’s relationships with its suppliers, its cash flow, and even its reputation.

Components of Invoice Management

- Invoice Receipt: The first step in the invoice management process is receiving the invoice from the supplier. This could be in various formats—paper-based, electronic mail, or through an electronic invoicing system.

- Invoice Verification: Once received, the invoice needs to be verified for accuracy. This involves matching the invoice data with purchase orders and delivery receipts to ensure that the billed goods or services were received at the agreed-upon price.

- Approval Workflow: After verification, the invoice goes through an approval process. This typically involves routing the invoice to various departments or personnel who need to sign off before payment can be made.

- Payment Scheduling: Upon approval, the invoice needs to be scheduled for payment. The payment terms should align with the supplier agreement to avoid late fees and maintain good relationships with suppliers.

- Record-Keeping: Every invoice needs to be recorded for accounting and compliance purposes. Detailed records make it easier for audits and also for tracking expenditure.

- Payment Execution: The final step is the payment of the invoice, usually through electronic funds transfer, cheque, or other payment systems.

- Reconciliation and Reporting: After payment, the transaction should be reconciled in the accounting system, and reports should be generated to provide insights into spending, cash flow, and other key financial metrics.

Forward-thinking businesses leverage intelligent invoice management technology to streamline their invoice management processes. Software solutions can automate many of the steps described above, reducing the chance of human error, expediting the approval and payment process, and making it easier to maintain complete and accurate records.

Why stay stuck in the paper chase? Artsyl InvoiceAction automates your invoice approval workflows for faster, smarter decision-making. Make the switch to automation and free your team from mundane tasks!

Book a demo now

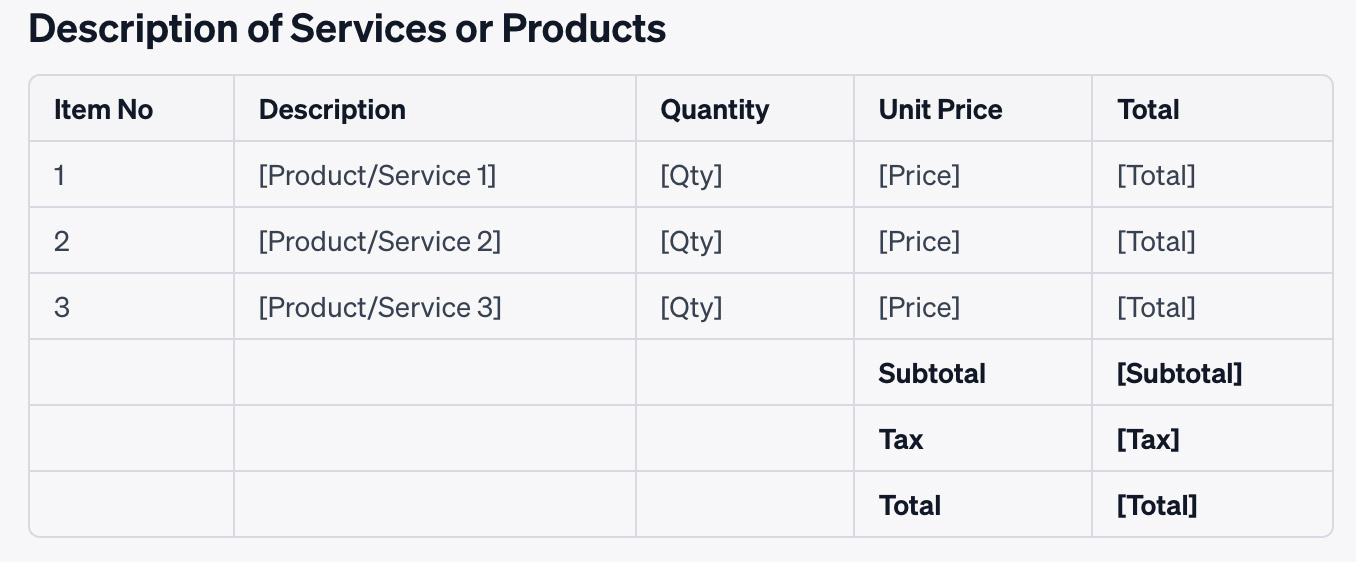

Create a Standard Invoice Template

Creating a standard invoice template can help you save time and avoid mistakes. Your invoice template should contain your company’s name and logo, the customer’s name and contact details, item descriptions, quantities, unit prices, and the total amount due. You can use online invoice generators to create professional-looking invoices that are easy to customize.

A standard invoice template usually contains several key components to ensure that it is comprehensive, accurate, and legally compliant. Below is a sample template you can use for invoicing purposes. You might need to customize the template to comply with specific industry regulations or client needs.

____

[Your Company Name]

Address: [Your Address]

Phone: [Your Phone Number]

Email: [Your Email]

Website: [Your Website]

Invoice No: [Invoice Number]

Date: [Date]

Due Date: [Due Date]

Bill To:

Name: [Client’s Name]

Address: [Client’s Address]

Phone: [Client’s Phone Number]

Email: [Client’s Email]

Ship To:

Address: [Shipping Address]

Payment Information

Please make the payment by the due date to the following bank account:

Bank Name: [Bank Name]

Account Name: [Account Name]

Account Number: [Account Number]

Sort Code: [Sort Code]

IBAN: [IBAN]

BIC/SWIFT: [BIC/SWIFT]

Notes:

[Add any additional notes, terms, or conditions here]

Thank you for your business!

___

This invoice template outlines the essential components including the billing and shipping information, a detailed list of products or services provided, unit costs, and total costs including any taxes.

Remember to include payment details and any other information your client needs to know to make the payment. Keep a copy for your own records to ensure accurate accounting and for tax compliance.

Get real-time insights into your financial management processes. From invoice tracking to detailed order analytics, Artsyl docAlpha has got you covered. Make data-driven decisions and optimize your financial processes now.

Book a demo now

Set Clear Payment Terms

Setting clear payment terms is a crucial aspect of managing accounts receivable and maintaining a healthy cash flow. Clearly defined payment terms eliminate ambiguity, reduce the likelihood of late payments, and can even help to avoid disputes over billing. Here are some guidelines to set clear payment terms:

Choose the Right Payment Terms for Your Business

- Net Terms: These are the most straightforward. For instance, «Net 30» means payment is due within 30 days of the invoice date.

- End-of-Month (EOM): This means that the payment is due by the end of the month following the one in which the invoice was received.

- Cash on Delivery (COD): The customer pays when the goods are delivered.

- Upfront Payments: For large projects or for new clients, you might ask for a percentage of the payment upfront.

Invoice Management Best Pratice: Be Specific and Transparent

- Due Date: Clearly state when the payment is due. Avoid vague terms like «Due upon receipt» unless you clarify what that means.

- Payment Methods: Clearly outline the acceptable methods of payment, whether it’s via bank transfer, credit card, or check.

- Late Fees: Specify any penalties for late payments, both the amount and the conditions under which they would apply.

Include All Payment Terms on the Invoice

- Detailed Itemization: Along with a clear due date and accepted payment methods, your invoice should offer a detailed itemization of services or goods provided.

- Notes or Comments Section: Use this area to reiterate payment terms or to offer any additional information such as your bank account details for wire transfers.

Communicate Before and After Sending the Invoice

- Preliminary Agreement: Discuss payment terms before you begin the project or deliver goods and ensure both parties are in agreement.

- Send a Reminder: Before the payment is due, consider sending a polite reminder.

Invoice Management Best Practice: Keep Documentation

- Contracts and Agreements: Always maintain a copy of any contracts or written agreements outlining the payment terms.

- Invoices and Receipts: Keep copies of all sent invoices as well as receipts acknowledging payment.

Be Flexible but Firm

- Flexibility: For long-term or highly valued clients, you might offer flexibility in payment terms or negotiate on the basis of their preferences or capabilities.

- Consistency: Once terms are agreed upon, be consistent in applying them. Make exceptions sparingly and for good reason.

By adhering to these best practices, you are more likely to facilitate timely payments and maintain a positive relationship with your clients. Research published in the Journal of Applied Business Research highlights the importance of credit terms in influencing customer payments, emphasizing the need for clarity and strategic thinking when setting these terms.

Clear and well-considered payment terms not only make the payment process smoother but can also be a competitive advantage for your business.

Are delayed payments affecting your vendor relationships? Improve your payment terms management with Artsyl InvoiceAction. Timely payments are just a click away. Don’t wait, automate!

Book a demo now

Understand the Importance of an Invoice Tracking System

Managing invoices manually is arguably one of the most backbreaking works that staff members have to go through in small businesses. It requires inputting data, recording payment process, tracking outstanding invoices, and more.

Without an invoice tracking system, managing these tasks can be a nightmare that’ll take up precious time, and all the while, your business’s financial health will suffer. Fortunately, so many tools and technologies have saved us the stress and labor of manual management of invoicing.

Streamlining the Invoicing Process with InvoiceAction

The value of InvoiceAction invoice automation software cannot be overstated when it comes to managing and streamlining business accounts. From automating the process of invoice creation to simplifying payments, tracking, and reconciliation, an effective invoicing system saves you time, effort, and resources that you can dedicate to growing your business.

Easy Payments with ArtsylPay

With an integrated payment processing in your invoice management system, you can streamline and speed up the payment process. Sending invoices to your clients becomes easy, and they’ll receive automatic payment reminders. Plus, you don’t need to follow up manually once payments are due- the system will do that for you, ensuring you get paid on time.

Better Cash Flow Management

Managing a business’s cash flow is a complex task, especially for small businesses. Fortunately, using advanced invoicing software lets you review and analyze every outstanding invoice, pending payments, and cash inflows to plan and execute financial strategies effectively.

An invoice management system such as InvoiceAction provides you with a clear and concise overview of your financial status, allowing you to predict future cash flows and make informed business decisions.

Keeping Accurate Accounting Records

Keeping an accurate record of financial transactions is critical to running a successful business. An invoice tracking system gives you an up-to-the-minute overview of what’s happening in your business’s accounts. You get a clear picture of what your customers owe you, and for those who’ve already paid, you know how much you owe them, making it easy to file taxes.

Overall, an effective invoice intelligent automation system such as InvoiceAction is crucial for businesses of all sizes and industries. With the right solution, businesses can streamline accounting processes, improve cash flow management, reduce the time spent invoicing, and ultimately boost the bottom line.

Rather than managing invoices manually or using outdated systems, integrated technology plus a centralized, automated billing process lets a company view all accounts receivable at a glance.

Whether you’re just starting out or managing a large firm, integrating a reliable invoice tracking system into your accounting process will make life easier and improve your bottom line.

Transform your accounting into a profit center with Artsyl docAlpha. Capture, process, and approve invoices with unprecedented efficiency. Start your journey toward streamlined AP operations today!

Book a demo now

Follow-Up on Late Payments

Late payments can be frustrating for any business owner or freelancer, especially when you depend on those payments to keep your finances flowing smoothly. If you find yourself in this situation, it’s important to take action and follow-up in a professional and tactful manner.

- Start by reaching out to the client or customer with a polite reminder of the late payment and inquire about the status of the payment.

- If you don’t receive a response or the issue isn’t resolved, it may be necessary to escalate the situation by sending a formal written notice or seeking legal assistance.

- Remember to stay assertive and professional, but also maintain a positive relationship with your client or customer to prevent any future payment delays.

With these strategies, you’ll be able to ensure timely payments and maintain a steady cash flow for your business.

Audit Your Invoices Regularly

Auditing your invoices regularly is a crucial element in ensuring that your financial records are accurate and up-to-date. By examining your invoices closely, you can quickly spot any errors or discrepancies within your financial records that could lead to larger issues down the line.

Conducting an audit will give you an insight into the financial performance of your business and help identify any areas where you can cut back to increase your profit margins. With the help of advanced accounting software and automation tools, auditing your invoices no longer needs to be a daunting task.

By taking the right steps to keep your books in order, you can safeguard the future success of your business.

Looking for a cloud-based invoice management solution that scales with your business?

Artsyl InvoiceAction is your answer. Secure, scalable, and incredibly efficient—find out how we can revolutionize your invoice management!

Book a demo now

Final Thoughts: Practice a Comprehensive Approach to Invoice Management

Good invoice management helps you maintain cash flow, avoid disputes, and maintain good relationships with customers. By following the tips above, you can streamline your invoicing process and ensure timely payments.

Remember to create a standard invoice template, set clear payment terms, set up a tracking system, follow up on late payments, and audit your invoices regularly. With the right tools and processes in place, invoicing management doesn’t have to be a headache.

Frequently Asked Questions: Invoice Management

What is Invoice Management?

Invoice management refers to the systematic process of receiving, processing, verifying, and paying supplier invoices. It’s an essential part of accounts payable and involves several stages, such as invoice capture, approval, payment, and archiving.

Why is Invoice Management Important?

Effective invoice management is crucial for optimizing cash flow, maintaining accurate financial records, and ensuring compliance with tax laws. It also helps to minimize errors, fraud, and late payment penalties.

What Are the Key Components of an Invoice?

Typically, an invoice will include the supplier’s name and contact details, the client’s name and contact details, a detailed list of goods or services provided, prices, date of issue, and payment terms.

How Can I Make the Invoice Management Process More Efficient?

- Automate the Process: Many businesses use invoice management software to automate repetitive tasks.

- Set Clear Payment Terms: Clearly state payment terms and deadlines.

- Digitize Records: Keep digital copies of all invoices for easier access and compliance.

What is a Purchase Order and How Does it Relate to Invoices?

A Purchase Order (PO) is a document sent from the buyer to the seller specifying the types of products or services to be purchased. When these goods or services are delivered, an invoice is generated, often referring back to the PO.

How Do You Handle Late Payments?

Late payments can be handled by sending polite reminders, imposing late fees as per the agreed terms, or as a last resort, taking legal action.

What are Net Payment Terms?

Net payment terms specify the number of days within which payment must be made for the supplied goods or services. For example, Net 30 means the payment is due within 30 days of the invoice date.

Can Invoice Management Be Integrated With Other Business Systems?

Yes, many invoice management systems offer integration options with accounting software, ERP systems, and other business tools for seamless operations.

What’s the Difference Between a Standard and a Pro Forma Invoice?

A standard invoice is a bill sent after the delivery of goods or services. A pro forma invoice is an estimate sent before the delivery, often used for customs purposes in international trade.

Is Invoice Management Only For Large Businesses?

No. Invoice management is essential for businesses of all sizes. Small businesses may start with manual processes or basic software, but as they grow, automation and integration with other systems become increasingly important.

The Ultimate Guide to Final Invoices

The Ultimate Guide to Final Invoices Credit Invoice or Credit Note? Find Out The Difference

Credit Invoice or Credit Note? Find Out The Difference Recurring Invoice: What is It?

Recurring Invoice: What is It? Debit Invoice and Debit Note: What Is It

Debit Invoice and Debit Note: What Is It Timesheet Invoice: What Is It?

Timesheet Invoice: What Is It? Exploring Various Invoice Types: Unveiling the Differences

Exploring Various Invoice Types: Unveiling the Differences